Zimbabwe’s Reserve Bank today abandoned plans to automatically convert export proceeds into the Rand and Euro currencies, the second tweak within a week of a major policy intervention, as it battles a crippling cash shortage.

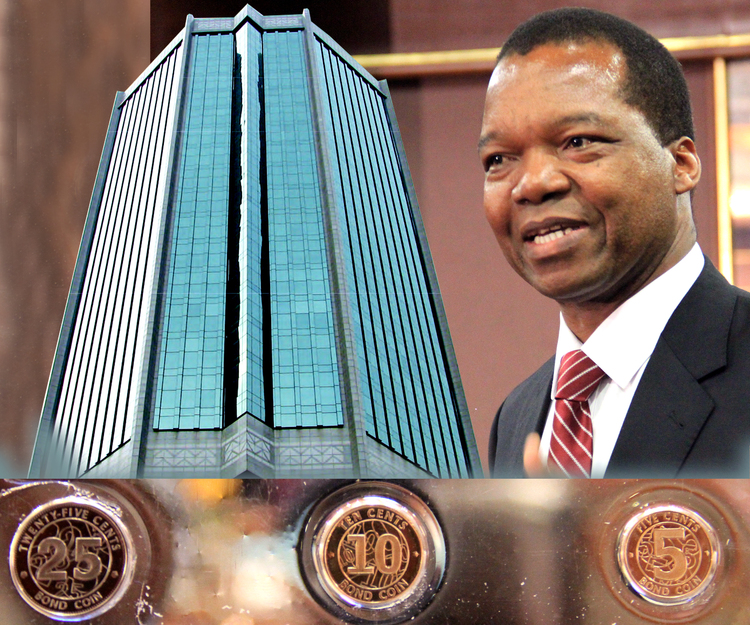

On May 4, the central bank announced a raft of measures, including plans to introduce domestic ‘bond notes’ to circulate alongside foreign currencies, but a public outcry triggered by fears of a return of a much loathed local currency prompted a ‘clarification’ on Friday last week, with governor John Mangudya describing the move as an export incentive.

Today, the central bank said it had scrapped plans, announced just last week, to convert 40 percent of all export proceeds into Rand and 10 percent into Euro. However, exporters would now have half of their earnings held in their banks’ accounts with the central bank.

“Authorised Dealers are advised that 50 percent of all new foreign exchange receipts from the export of goods and services denominated in USD shall be transferred into the Reserve Bank immediately on receipt of funds. The remaining 50 percent shall be credited into the exporter’s FCA in USD,” said the central bank in a statement.

“On receipt of the 50 percent export proceeds into its Nostro Account, the Reserve Bank shall immediately credit the same amount plus the 5 percent export incentive /bonus in USD into the Authorised Dealer’s RTGS Account for the exporter. Accordingly, the requirement for the apportionment of 50 percent of foreign exchange receipts into 40 percent ZAR and 10 percent EUR, has been removed with immediate effect.”

Exporters receiving proceeds in other currencies will get 100 percent of their earnings credited to their corporate FCA accounts immediately, plus the 5 percent bonus.

RBZ’s swift shift on policy may be the result of pressure from exporters, who had criticised the conversion of part of their USD earnings into weaker currencies, particularly the volatile rand. Legal experts had also advised that the conversion could have exposed the bank to possible litigation. It is unclear how exporters will receive the new measure announced today.

The RBZ also announced the removal of a 10 percent Nostro account threshold by banks. Also removed is a 15 percent cash holding requirement announced in September 2014.-The Source

Related stories:

Tsvangirai calls emergency national executive meeting Thursday to decide way forward on bond notes

It’s a stimulus package- Mangudya says

Tsvangirai to convene his cabinet tomorrow to discuss proposed bond notes

Bond notes -a legal perspective

Zimbabwe stems illicit outflows

Cash shortages – the real causes and the wrong diagnosis

New bond notes-key questions answered

Mangudya full statement on the introduction of bond notes

Highlights of RBZ intervention on cash shortages

MDC says Mugabe is bringing back Zimbabwe dollar through the back door

Zimbabwe to introduce bond notes as cash shortages bite

(375 VIEWS)