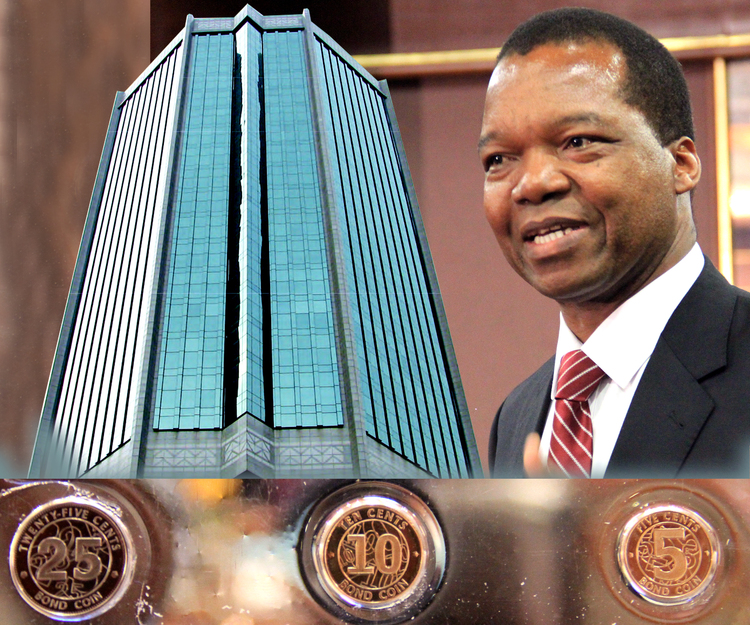

Zimbabwe’s central bank yesterday imposed tight cash withdrawal limits and announced plans to introduce local “bond notes” to circulate alongside a basket of foreign currencies adopted in 2009, in a bid to ease widespread cash shortages stalking its sluggish economy.

Below are highlights of the central bank announcement:

- To introduce bond notes in $2, $5, $10, and $20 denominations, backed by a $200 million AFREXIM facility. The bond notes will be introduced in not less than two months from now.

- Imposed daily bank withdrawal limits to $1000, Euro 1000, Rand 20 000 with effect from 5 May 2016.

- 40 percent of all foreign currency receipts from the export of goods and services including gold and tobacco sales to be converted to South African Rand and 10 percent to Euro. Diaspora remittances and NGO funds to exempted from this conversion.

- The central bank has established a $200 million export incentive facility backed by AFREXIM to provide a 5 percent incentive on all foreign currency receipts including tobacco and gold.

- Banks to allocate foreign currency according to four priority levels.

Priority One

- Net exporters who import raw materials and machinery

- Non-exporting importers of raw materials and machinery for value addition and import substitution

- Strategic imports such as basic foodstuffs, fuel, medicines

- Repayment of off-shore lines secured to fund production

- Payments for services not available in Zimbabwe

- Dividend payments

Priority Two

- Bank borrowing clients in the productive sector engaged in critical and strategic imports

Priority Three

- University and college fees for students already enrolled in courses abroad

- Cash depositing clients in the retail and wholesale industry

- Other borrowing clients engaged in the importation of non-strategic goods.

Not priority

- Capital remittances from disposal of local property

- Capital remittances from cross-border investments

- Funding of offshore credit cards

- Importation of trinkets and/or goods or services readily available in Zimbabwe including vehicles, maheu, bottled water, vegetables.

- Donations

(94 VIEWS)