The answer is YES. But what is not clear is the size of the stake or the vehicle that he used to invest in Zimbabwe’s largest mobile phone operator and financial powerhouse.

The answer is YES. But what is not clear is the size of the stake or the vehicle that he used to invest in Zimbabwe’s largest mobile phone operator and financial powerhouse.

A shareholder analysis of Econet shows that Econet Global Limited is the company’s biggest shareholder with 38.4% of the shares as of February 2021, the latest published annual results of the Zimbabwe Stock Exchange listed company.

Stanbic Nominees (NNR) owns 14.1%, Stanbic Nominees 12.4%, Old Mutual 6.4%, Econet Wireless Zimbabwe SPV 5%, New Arx Trust (NNR ( 3.6%, Austin Eco Holdings (NNR) 2.1%, Standard Chartered Nominees 1.3%, National Social Security Authority 1.1% and Northunderland Investments 0.9%.

George Soros’s investment in Econet, Zimbabwe’s second largest company by market capitalisation, was disclosed by none other than the company’s biggest shareholder Strive Masiyiwa in an obscure comment following his Facebook post entitled Control or Growth Part 5 where he discusses how he decided to list Econet in order to raise capital.

George Soros’s investment in Econet, Zimbabwe’s second largest company by market capitalisation, was disclosed by none other than the company’s biggest shareholder Strive Masiyiwa in an obscure comment following his Facebook post entitled Control or Growth Part 5 where he discusses how he decided to list Econet in order to raise capital.

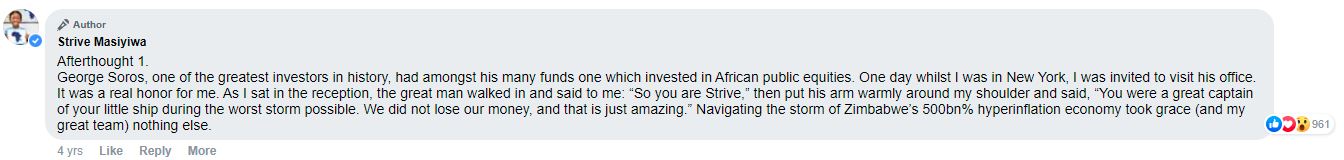

Way down the comment section Masiyiwa wrote: “George Soros, one of the greatest investors in history, had amongst his many funds one which invested in African public equities. One day whilst I was in New York, I was invited to visit his office. It was a real honor for me. As I sat in the reception, the great man walked in and said to me: ‘So you are Strive,’ then put his arm warmly around my shoulder and said, ‘You were a great captain of your little ship during the worst storm possible. We did not lose our money, and that is just amazing.’ Navigating the storm of Zimbabwe’s 500bn% hyperinflation economy took Grace (and my great team) nothing else.”

The post does not say when Masiyiwa met Soros but seems to imply that Soros has been invested in Econet when Zimbabwe faced its worst economic crisis which culminated in one of the highest inflation rates in the world in 2008. Masiyiwa has since closed his Facebook account.

The post does not say when Masiyiwa met Soros but seems to imply that Soros has been invested in Econet when Zimbabwe faced its worst economic crisis which culminated in one of the highest inflation rates in the world in 2008. Masiyiwa has since closed his Facebook account.

While the government stopped publishing inflation figures when it reached 500 billion percent, United States economist Steve Hanke said it reached 89.7 sextillion percent. A sextillion is a number followed by 21 zeros.

Soros, who turns 92 in August, is reputed as a ruthless investor with no respect for governments and is trying to change the world through his Open Society Foundations which sponsor human rights groups and the media and is known to have funded violent protests including in the United States of America.

According to the Forbes real-time billionaires rich list accessed today, Soros is ranked 267 with a networth of US$8.6 billion while Masiyiwa is ranked 1060 with a networth of US$3 billion.

A well known Zimbabwe African National Union-Patriotic Front sympathiser David Matsanga Nyekorach claimed in a broadcast which has since been removed from YouTube that Soros was behind the 1 August 2018 violence that resulted in six people being killed as they protested against the delay in the announcement of the presidential election results for that year.

He said that Soros and chair of The Elders Kofi Annan had planned to rig the elections in Zimbabwe in favour of Movement for Democratic Change Alliance leader Nelson Chamisa. When they realised that their plan had flopped they triggered the violence that engulfed Harare on 1 August before the full election results had been released so that they could get the whole election process condemned.

Soros is, however, best known for breaking the bank of English when he made a cool US$1 billion in a single day on 16 September 1992 after short-selling the British pound.

Econet also been blamed for playing havoc with the Zimbabwe dollar. In September 2020 President Emmerson Mnangagwa accused Ecocash, a subsidiary of Econet of creating $8.4 billion in phantom money which he said was fueling inflation.

Inflation at the time was 659.4% having peaked at 837.5% in July of the same year. It was down to 50.2% in August 2021 but has since risen to 72.7% as of last month.

(265 VIEWS)