- The addendum materially varied the duration of the agreement. It now provided that the agreement would run for a period of ten (10) years “calculated from each implementation date”.

- The phrase “implementation date” is defined in the main agreement to mean “the date the System Software is physically commissioned and ZINARA has productive use of the System for the collection of fees, including vehicle licence and other income,”

- In terms of both agreements, the fees to be paid by ZINARA excluded Value Added Tax (VAT) which was to be paid by ZINARA “in addition to all fees, invoices and licences”

- On 7 February 2014, a further agreement headed “Second Addendum to the Concession for the Supply and Commissioning of the Computerization of the Transit Fee and Fuel levy in Zimbabwe” was signed.

- This agreement reproduced as part of Annexure 22 to Volume 1 of the Audit Report was a short one, but with drastic legal and financial implications.

- It allowed Univern, to collect a fee for Road Transit Fees and Fuel levy from income derived from the Road Transit System and Fuel Levy System supplied by Univern.

- All the other terms of the agreement as reflected in the Main Agreement and the First Addendum remained the same.

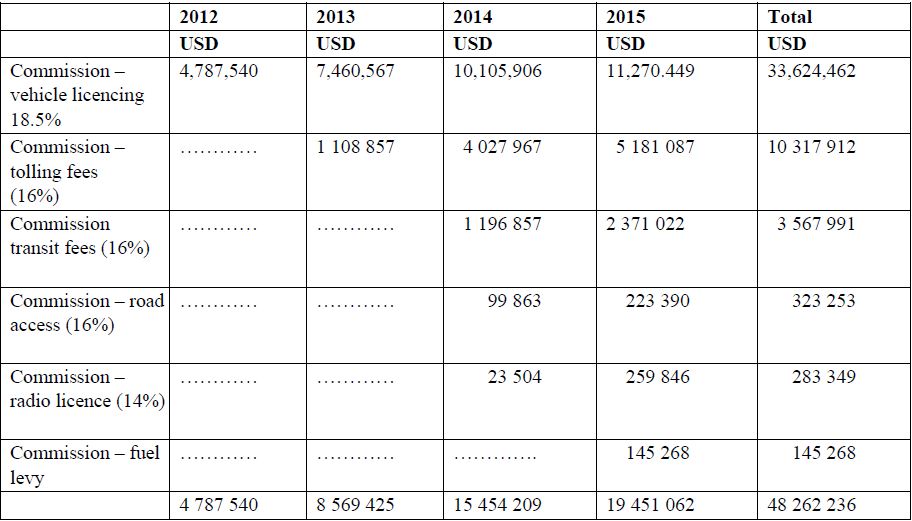

- The financial implications of these agreements is massive. In real terms to the extent that ZINARA was paying VAT, over and above the gross revenue collected, ZINARA was paying the following;

- 16% Toll Fee, (18.4%)

- 18.5% Vehicle Licensing (21.275%)

- 16% Vehicle Levy System (18.4%).

- For the period under review, the following figures were collected:

(254 VIEWS)