PRESS STATEMENT

REDUCTION OF CASH WITHDRAWAL CHARGES

The Reserve Bank has noted that while cash withdrawal limits have reduced significantly during the second half of 2016, there has not been a proportionate reduction in the level of bank charges.

Against this background and as part of the on-going efforts to promote financial inclusion and to ensure that banking products and services are affordable to the banking public, the Reserve Bank has reviewed cash withdrawal charges downwards with effect from 12 December 2016.

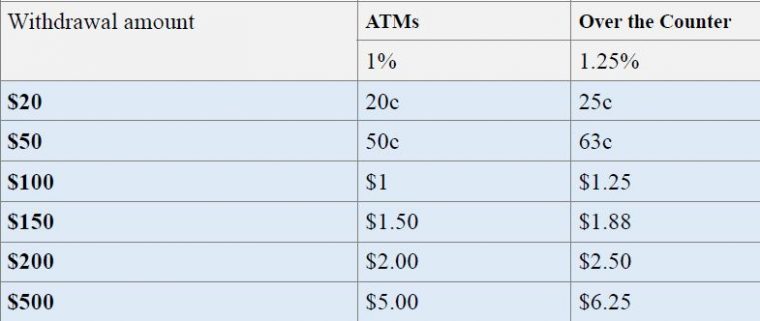

In order to align cash withdrawal charges to amount withdrawn, a proportional pricing model has been adopted to replace the current fixed charges. The applicable charges for cash withdrawal is a maximum of 1% and 1.25% of amount withdrawn for ATM and over-the counter, respectively as indicated below:

The Reserve Bank will continue to monitor the cost of bank charges to ensure access to affordable banking services and at the same time promote the use of plastic money.

DR. J.P. MANGUDYA

GOVERNOR

12 December 2016

Withdrawal amount ATMs Over the Counter

(92 VIEWS)