The cash shortages in Zimbabwe have seen electronic transactions skyrocket from $6.8774 billion in2009 when the country dollarised to $80.0026 billion this year, Finance Minister Patrick Chinamasa told Parliament yesterday.

In a ministerial statement explaining the current cash crisis in the country which led to panic over the weekend, Chinamasa said 75 percent of the transactions in the country were now electronic.

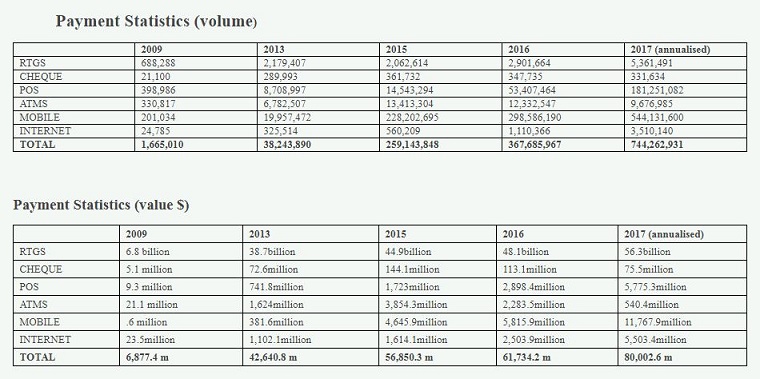

“In 2009 RTGs transfers were 688 288 whereas in 2017 these are 5 351 491. Total electronic transfers moved from 1 665 010 in 2009 to 744 262 931 in 2017. In value terms RTGs transactions were $6.8b in 2009 and have jumped to $56.3b in 2017. Total value of electronic transactions moved from $6.8774b in 2009 to $80.0026b in 2017,” he said.

Chinamasa acknowledged that the present cash shortage was due to lack of confidence, discipline as well as rent-seeking behaviour.

“There is one billion of physical cash in circulation made up of $180 million in bond notes, $28 million in bond coins and US$800 million. We consider this one billion to be sufficient if it was circulating efficiently. The $1 billion translates to around 15% of deposits which is international best practice in normal economies,” he said.

(132 VIEWS)