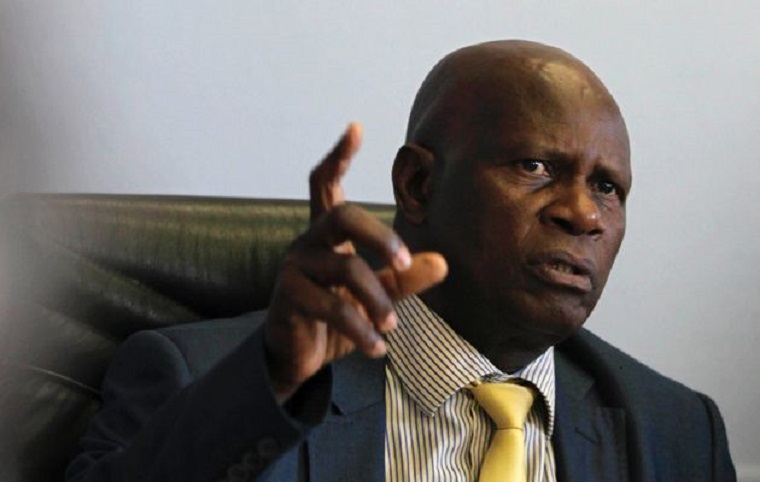

Zimbabwe Finance Minister Patrick Chinamasa urged Zimbabweans to change their mindsets and value the stock they owned because this was a form of wealth which they could easily convert to cash if they traded it. He said this during the second reading of the Movable Property Security Interests Bill, which will allow people to use movable assets like livestock and vehicles as collateral. Below is the full debate.

MOVABLE PROPERTY SECURITY INTERESTS BILL [H.B. 7A, 2016]

First Order read: Second Reading: Movable Property Security Interests Bill (H.B. 7A, 2016).

THE MINISTER OF FINANCE AND ECONOMIC DEVELOPMENT (HON. CHINAMASA): Madam President, I rise to present the Movable Property Security Interests Bill [H.B. 7A, 2016], for consideration by this august House. The main principle objective of this Bill is to provide a framework within which movable property may be used as collateral or security for purposes of obtaining loans upon reasonable terms from the financial services sector, that is from the commercial banks.

Madam President, in order to allow a wider demography of our citizens access to bank loans at reasonable interest rates and in equal measure, to provide players in the financial sector the additional comfort offered by security, we have considered it fit to introduce this Bill to spare enterprise development and at the same time to promote stability in the financial services sector.

Principally, Madam President, the initiative entails the establishment of a collateral registry of movable property such as machinery, automobiles, inventory and account receivables. The registry will serve as a central source of information and will facilitate commerce, industry and other economic activities by enabling individuals and business to utilise their movable assets as collateral for credit, thereby injecting vitally important liquidity into their respective enterprises. The initiative promotes the availability of credit by significantly diminishing the risk assumed by lenders as they may bond movable assets as collateral and have immediately available recourse where a borrower defaults in loan repayment.

As alluded to, in the 2016 National Budget Statement, access to finance is one of the most important components for sustainable business and economic growth in any economy in the world.

However, Madam President, the majority of Zimbabweans are not able to access credit from financial institutions due to lack of acceptable security in the form of immovable property such as houses or factories which are traditionally preferred by formal lending institutions. This Bill seeks to specifically address this gap.

Continued next page

(492 VIEWS)