Oil companies in Zimbabwe will from tomorrow buy dollars to import fuel on the interbank market after the central bank ended the1:1 peg to the dollar that the firms were using, the bank said, a move that could see the price of fuel going up.

Oil companies in Zimbabwe will from tomorrow buy dollars to import fuel on the interbank market after the central bank ended the1:1 peg to the dollar that the firms were using, the bank said, a move that could see the price of fuel going up.

The Reserve Bank of Zimbabwe introduced a new local currency and an interbank market in February to allow companies and individuals to trade in forex.

Importers of fuel were, however, allowed to buy dollars from the central bank at a rate of 1:1 to the greenback.

The arrangement was reported to be benefitting a cartel controlled by Singapore based Trafigura which is represented by Sakunda Holdings in Zimbabwe.

Movement for Democratic Change vice-chair Tendai Biti, who was the country’s Finance Minister from 2009 to 2013 said British-Swiss multinational Glencore was also part of the cartel because it controlled the pipeline.

The pipeline is officially owned by the Companhiado De Pipeline Mozambique-Zimbabwe (CPMZ) and the National Oil and Infrastructure Company of Zimbabwe.

Biti refused to disclose the local partner for Glencore but banker John Mushayavanhu of FBC Holdings said in 2014 he obtained a US$29.325 million loan from Glencore UK to buy a 51 percent stake in Zuva Petroleum which held 73 assets that previously belonged to BP and Shell.

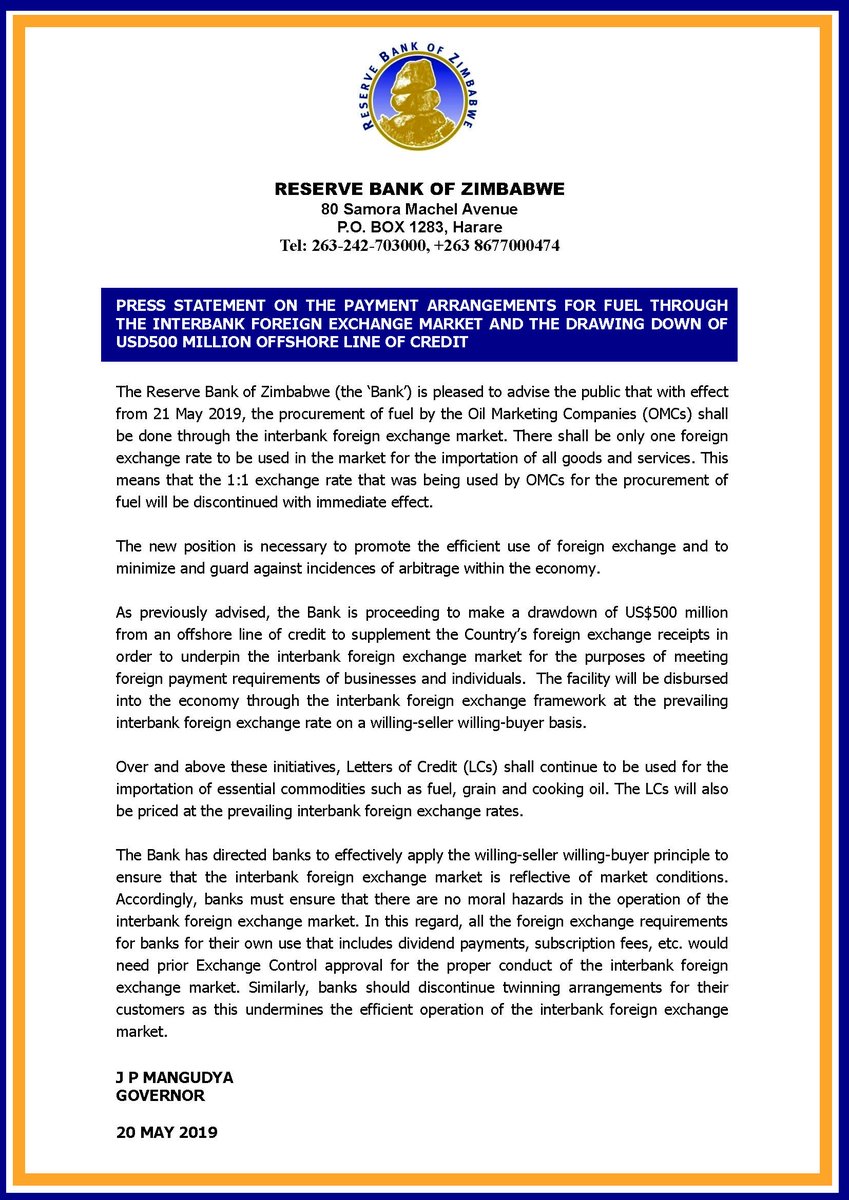

Central bank governor John Mangudya said in a statement today, the 1:1 arrangement had been terminated and fuel companies would only access dollars on the interbank market from tomorrow.

“The new position is necessary to promote the efficient use of foreign exchange and to minimize and guard against incidences of arbitrage within the economy,” he said.

By obtaining currency at 1:1, it was more profitable for oil importers to sell their foreign currency on the black market than to sell fuel which costs less than a dollar on both the interbank and the parallel market rates.

Mangudya directed banks to ensure that the official exchange rate reflected market conditions.

Banks and companies had accused the central bank of manipulating the official exchange rate to keep the rate low compared to the black market.

Mangudya said at the weekend that the central bank had accessed a $500 million from international banks.

An official at the national treasury said African Export and Import Bank, which has continued to loan money to Zimbabwe in the absence of donor funding, had arranged the latest loan.-TR/OWN

(122 VIEWS)