The Zimbabwe dollar today appreciated by 12 cents against the United States dollar as the year comes to a close with two more likely auctions before the year ends.

The Zimbabwe dollar today appreciated by 12 cents against the United States dollar as the year comes to a close with two more likely auctions before the year ends.

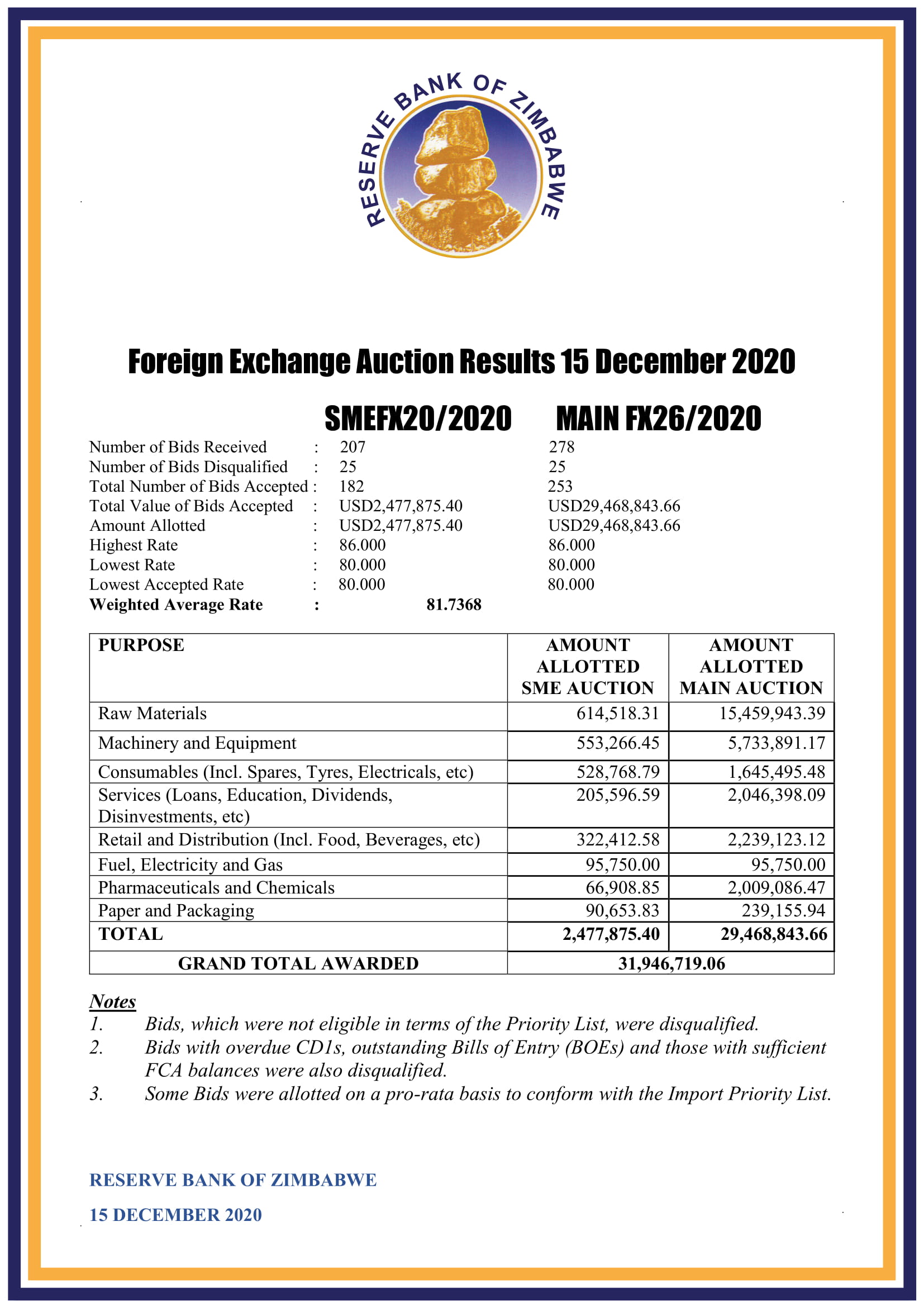

A total of US$31.9 million was allotted today at both the Small and Medium Enterprises auction and the Main auction. Some 435 bids qualified and 50 were disqualified.

The dollar remained within range with the highest offer at $86 and the lowest at $80 with today’s average at $81.7368 up from $81.8572.

US$595.4 million has so far been disbursed through the auction since it started on 23 June.

It is not clear when the next auction will be held at 22 December is a public holiday.

A study carried out for the Confederation of Zimbabwe Industries recently concluded that money supply and memory or people’s expectations were the main drivers of exchange rate volatility in Zimbabwe.

“Other variables such as the fiscal balance and trade openness insignificantly explain volatility of the exchange rate. However, some components of government expenditure, in particular expenditures on capital and programmes, drive volatility of the exchange rate,” the study said.

The study said that confidence issues that emanate from bad memories about the financial sector and previous monetary policies are a key driver of exchange rate variation.

“What is, however, worth noting is that these memories emanate from some monetary shocks. Hence, monetary targeting remains central in the management of exchange rate growth and volatility in Zimbabwe.

“The main policy implication of the findings is that any slight change in money supply triggers bad memories about the past thereby fueling instability in the exchange rate.

“Rebuilding confidence in the financial sector and in monetary policy is not a short-term activity since it takes time for economic agents to forget about the bad memories. It is, however, important for monetary authorities to reconstruct confidence for a better future.”

The study said reserve money targeting can still adequately address exchange rate volatility in Zimbabwe as long as authorities stick to prudent macroeconomic management.

“In addition to monetary targeting, the study further recommends perpetuation and strengthening of good macroeconomic management practices. If the macroeconomic fundamentals continue to perform well and money supply growth is kept in check then the bubble experienced in the exchange rate growth since the first quarter of 2019 will disappear.

“In other words, the auction rate will converge to the parallel exchange rate as long as money supply and the other macroeconomic variables are kept in check. With the current macroeconomic performance, the limited levels of reserves and the state of macroeconomic management, the run-away exchange rate is predicted to stabilize within the range 80 to 95.”

(101 VIEWS)