The Zimbabwe Gold (ZiG) has brought some stability into the market enabling some smoothness for business operations, IH Securities says in its commentary on the mid-year budget review presented on Thursday.

The Zimbabwe Gold (ZiG) has brought some stability into the market enabling some smoothness for business operations, IH Securities says in its commentary on the mid-year budget review presented on Thursday.

Finance Minister Mthuli Ncube said he expected the economy to grow by 2% down from 3.5% he predicted when he presented the 2024 budget. This was largely due to the poor agricultural season which was initially forecast to contract by 4.9% but contracted by 21.2%.

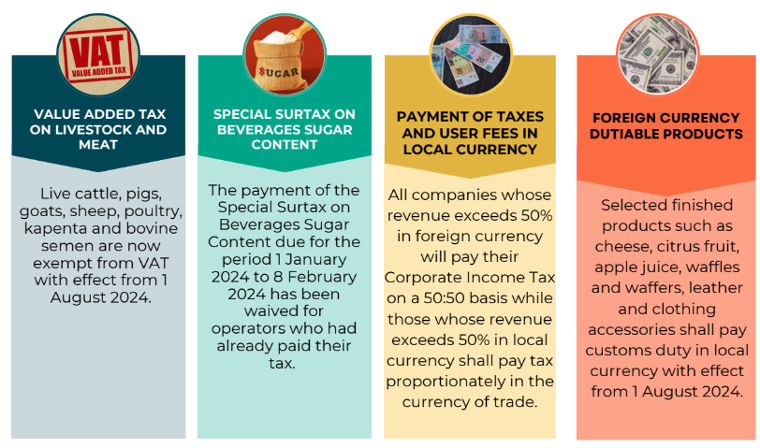

Ncube introduced a raft of measures to promote use of the local currency including compelling firms to pay half their taxes in local currency. He also listed selected goods whose duty will have to be paid in local currency from 1 August and ordered that user fees for government services will be paid in local currency unless specified.

“In our view, the introduction of ZiG has brought some stability into the market enabling some smoothness for business operations,” the securities firm said. “The proposed amendment to Corporate Income Tax for net earners of USD will likely require them to liquidate some of their forex through official channels, thereby supporting dollar liquidity. The government will however still have to fund its forex obligations.

“Post the introduction of ZiG, we have seen the market strengthen, also aided by the removal of minimum vesting periods. Market capitalization on the ZSE since the introduction of the structured currency has moved 114% to date.”

The ZiG, which was introduced on 5 April, has stood its ground against the United States dollar and has traded between 13.2 and 13.7 over the past three months.

It is anchored on reserves that now total US$370 million up from US$285 million when it was introduced.

An estimated US$2 billion is said to be in circulation in Zimbabwe. The US dollar accounts for 70% of transactions in the country down from 80% when the ZiG was introduced.

The central bank aimed to raise the level of settlements in local currency from 20% to 30% by the end of the year but it has already acheived this. Central Bank governor John Mushayavanhu has not announced the new target for year-end.

(249 VIEWS)