The Zimbabwe dollar has firmed 53% against its US counterpart over the past month, making it the world’s best performer, but the central bank is resigned to the greenback remaining key to transacting in the southern Africa nation for the foreseeable future.

The Zimbabwe dollar has firmed 53% against its US counterpart over the past month, making it the world’s best performer, but the central bank is resigned to the greenback remaining key to transacting in the southern Africa nation for the foreseeable future.

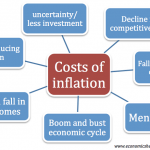

Citizens lost confidence in the local currency due to their prior experience of hyperinflation that ensued after its value plunged more than a decade ago, and the authorities now have to deal with a “perception and mindset” that dealing in it is risky and can lead to losses, according to Governor John Mangudya.

That has led the central bank to be circumspect when considering whether it should make the local unit the sole legal tender, and a comprehensive study to weigh the advantages and disadvantages is needed before any decision is taken, he said.

“A big bang approach is not advisable,” Mangudya said. Confidence in the Zimbabwe dollar is only likely to strengthen after the authorities demonstrate policy consistency, third parties endorse its usage and there is increased public awareness about its benefits, he said.

The Zimbabwe dollar has had a rocky history. It was abandoned in 2009 when hyperinflation set in, and the country began using mainly the US currency. It was reintroduced in June 2019 and the use of others was outlawed, but that policy was reversed in April 2020 following the onset of the coronavirus pandemic.

The local unit fell 84% against the greenback in the official market in May, but recouped losses after the government liberalised the exchange rate and ordered the settlement of corporate taxes in the domestic currency in a bid to boost demand. A US dollar currently fetches 4 523 Zimbabwe dollars on the official market, compared with 6 926 before the changes were announced, data on the central bank’s website shows. The gains raised speculation that the authorities may change the currency regime.

The prevailing multi-currency system negates the relevance of the Zimbabwe dollar, as consumers have little incentive to hold it or transact in it, Imara Edwards Asset Management, the country’s oldest brokerage firm, said in a 19 July note to clients. “Our greatest fear is another premature legislated use of Zimbabwe dollars,” it said.

Zimbabwe’s current laws allow for the greenback to be used until 2025.

While about 75% of transactions take place in US dollars, the country lacks the capacity to dollarize the economy in its entirety, Mangudya said.- Bloomberg

(81 VIEWS)