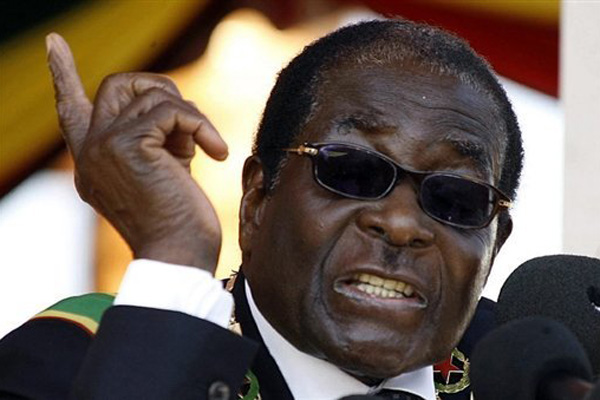

Zimbabwe’s President Robert Mugabe has issued regulations providing the legal basis for the issuance of ‘bond notes,’ a surrogate currency his government hopes will ease a biting US dollar bank note shortage, according to a government notice issued yesterday.

Zimbabwe informally dollarised in 2009 to tame hyperinflation which peaked at 500 billion at the height of a political and economic crisis in 2008, but has experienced an acute shortage of US dollar notes since the beginning of the year, blamed on the country’s ever widening trade gap, among other factors.

According to an extraordinary government gazette, Mugabe used the Presidential Powers (Temporary Measures) Act to amend the Reserve Bank of Zimbabwe Act to designate bond notes as legal tender.

A bond note unit (dollar) will trade at par with one US dollar, according to the notice.

The presidential powers Mugabe invoked to clear the legal hurdle for the issuance of the bond notes, which he has described as a surrogate currency, allow the president to make regulations to urgently deal with matters relating to defence, public safety, public order, public morality, public health or the country’s economic interests.

The central bank is now expected to bring the local currency into circulation this week.

In May, the central bank announced its plans to circulate bond notes alongside the US dollar and other currencies in Zimbabwe’s multi-currency basket, which also includes South Africa’s rand, Botswana’s pula, China’s yuan, the euro, British pound and Japan’s yen.

The central bank says the surrogate currency will be backed by a $200 million facility provided by the African Export Import bank.

After the hyperinflation crisis which wiped savings and deepened poverty, the central bank’s plans to issue a local currency have raised fears that the Mugabe government, which projects a $1 billion budget deficit this year (7 percent of GDP and 25 percent of the 2016 budget) will once again stoke inflation by resorting to printing money.

The plans have triggered some legal challenges and a series of street protests, including possibly the biggest anti-Mugabe demonstration in a decade, held on July 6.

The central bank has repeatedly promised not to print bond notes beyond the $200 million backing, insists the bond notes are primarily an incentive for exporters, who will get up to 5 percent of the value of their exports, paid in the local currency, in a bid to close a trade gap which has seen the country ship out $20 billion for imports since 2009.

In 2014, the RBZ introduced bond coins, backed by a $50 million AfreximBank facility in a bid to resolve the shortage of small change. Despite initial skepticism and resistance, the coins have gained widespread acceptance and use in the economy.-The Source

(214 VIEWS)