The government has moved to amend the Reserve Bank of Zimbabwe Amendment Act through Parliament to regularise the introduction of ‘bond notes,’ a surrogate currency designed to arrest a biting dollar note shortage, following legal challenges to President Robert Mugabe’s use of a decree to ramrod the new currency into the economy.

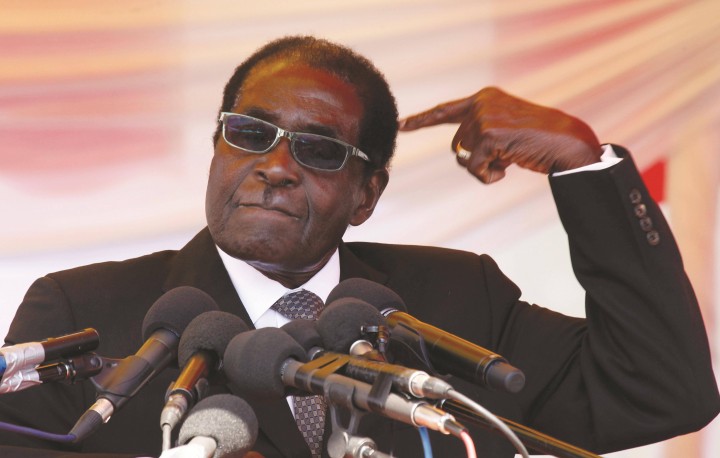

Last month, Mugabe invoked the Presidential Powers (Temporary Measures) Act to amend the Reserve Bank of Zimbabwe Act to designate bond notes as legal tender.

But lawyers have said the use of presidential powers was unconstitutional while the Zimbabwe Lawyers for Human Rights (ZHLR) on Monday challenged the introduction of bond notes in the High Court.

“The Presidential Powers (Temporary Measures) Act is patently unconstitutional,” said legal expert Alex Magaisa in reaction to the decree.

“You can’t amend primary legislation using secondary legislation. The constitution specifically prohibits it. Section 134 of the Constitution makes it clear that making primary legislation is a job for Parliament only.”

According to an extraordinary government gazette published on Wednesday, government is now seeking to introduce the Reserve Bank Amendment Bill in parliament. According to Clause 4 of the Bill, it “will statutize the provision for the issuance of bond notes temporarily enacted by the Presidential Powers (Temporary Measures) (Amendment of Reserve Bank of Zimbabwe Act and Issue of Bond Notes) Regulations, 2016. It will also validate the issuance of bond coins in circulation before that time”.

A bond note unit (dollar) will trade at par with one US dollar, according to the government notice.

The Bill will require parliamentary clearance — which Mugabe tried to side-step with his proclamation — despite his Zanu-PF party having a two thirds majority.

In May, the central bank announced its plans to circulate the token currency alongside the US dollar and other currencies in Zimbabwe’s multi-currency basket, which also includes South Africa’s rand, Botswana’s pula, China’s yuan, the euro, British pound and Japan’s yen.

Continued next page

(235 VIEWS)