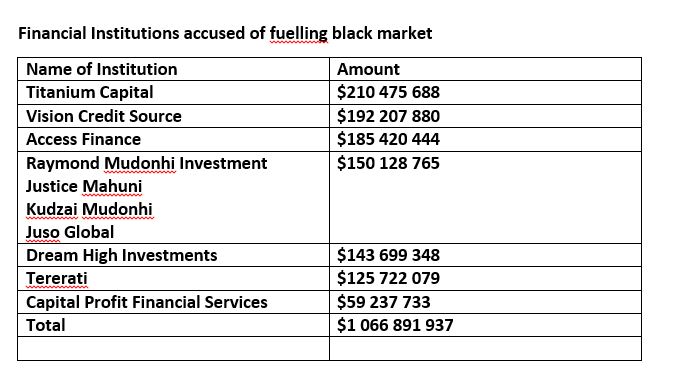

Eight financial institutions are now before the courts for violating exchange control violations after they dished out over $1 billion onto the streets to buy foreign currency using Ecocash bulk payer lines.

Eight financial institutions are now before the courts for violating exchange control violations after they dished out over $1 billion onto the streets to buy foreign currency using Ecocash bulk payer lines.

According to The Herald, the eight are Titanium Capital, Dream High Investments, Access Finance, Tererati, Vision Credit Source, Capital Profit Financial Services, Raymond Mudonhi Investment (Justice Mahuni, Kudzai Mudonhi) and Juso Global Limited.

The amount involved is just a fraction of the rot.

The amount involved is just a fraction of the rot.

President Emmerson Mnangagwa said in September last year that the government had cracked down on Ecocash after it had discovered that Ecocash had created $8.4 billion in phantom money.

He said that some people with no source of income at all were trading as much as $86 million a day from their Ecocash accounts.

Eddie Cross, a member of the Monetary Policy Committee at the time, said that the central bank discovered that in February alone, Ecocash turned three times the amount that all the country’s 13 commercial bank combined had turned over.

He said that Ecocash’s 96 bulk payers in February alone transferred $3.8 billion to Ecocash trust accounts.

The money was used to buy foreign currency on the black market through some 75 000 agents, pushing the black market rate to as high as $200 to the United States dollar.

The Zimbabwe dollar stabilised when the country introduced the foreign exchange auction market in June last year but the gap between the auction rate and the black market rate has been widening of late.

The local currency is now trading at almost double the auction rate.

(421 VIEWS)

Pingback: Zimbabwe names 30 individuals for illegal forex dealings and bars them from accessing financial services for two years | The Insider

Pingback: Zimbabwe dollar falls by 74 cents as RBZ cracks down on illegal forex dealers | The Insider

Pingback: Zimbabwe dollar falls by 89 cents as the central bank continues crackdown on forex abusers | LacedMag