The Reserve Bank of Zimbabwe has directed all mobile payment system providers and merchants to stop cash-in and cash-out with immediate effect to try to stabilise the exchange rate.

The Reserve Bank of Zimbabwe has directed all mobile payment system providers and merchants to stop cash-in and cash-out with immediate effect to try to stabilise the exchange rate.

An International Monetary Fund mission that was in the country this month said Zimbabwe must tighten its monetary policy to stabilise the exchange rate.

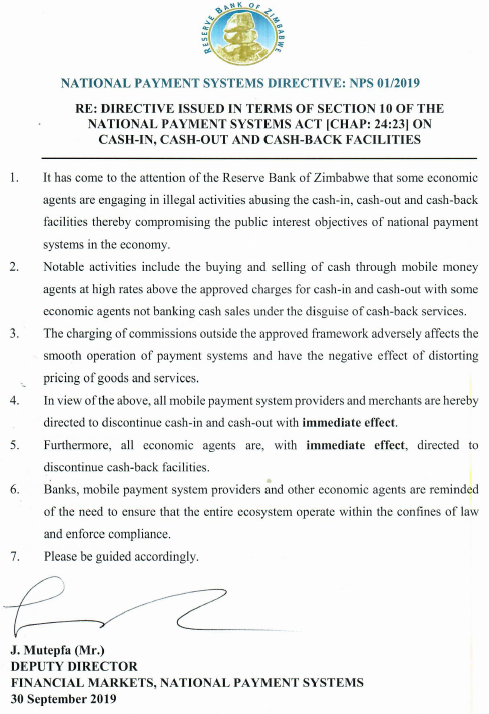

In a statement signed by Josephat Mutepfa, Deputy Director, Financial Markets and Payment Systems, the RBZ today said that some economic agents were engaging in illegal activities abusing the cash-in, cash-out and cash-back facilities thereby compromising the public interest objectives of national payment systems in the economy.

“Notable activities include the buying and selling of cash through mobile money agents at high rates above the approved charges for cash-in and cash-out with some economic agents not banking cash sales under the disguise of cash-back services,” the statement said.

“The charging of commissions outside the approved framework adversely affects the smooth operation of payment systems and have the negative effect of distorting pricing of goods and services.

“In view of the above, all mobile payment system providers and merchants are hereby directed to discontinue cash-in and cash-out with immediate effect.

“Furthermore, all economic agents are, with immediate effect directed to discontinue cash-back facilities.”

The RBZ has frozen the accounts of nine companies that are alleged to be involved in fuelling the black market.

(115 VIEWS)