The Grain Marketing Board (GMB) posted a loss of $208.9 million in the 2016/17 season after government ordered it to buy maize from farmers at $390 and resell at $240 per tonne.

GMB general manager Rockie Mutenha told a Parliamentary Committee Portfolio on Lands and Agriculture that the price difference contributed to the financial loss and must classified as a subsidy or import substitution.

“This is an import substitution, because if the millers say that they want to buy in Zambia; its foreign currency which is going outside the country. Therefore government has made a deliberate position of selling maize lower than cost as an import substitution,” said Mutenha.

Zambia sells maize at $130 per tonne at its silo.

GMB has received a total of 1.484 million metric tonnes of grains with a total value of $603.9 million as at 22 January 2018.

As at 18 January 2018, grain stocks stood at 1.233 million metric tonnes with maize stocks at 1.018 million metric tonnes, wheat 107 418 metric tonnes, small grains, 97 687 metric tonnes and soya beans 10 357 metric tonnes.

So far GMB has paid for 99 percent of the grain delivered, said Mutenha.

“To date total grain sales amount to 290 031 worth $62 370 895. As at 18 January 2018, Grain Millers Association of Zimbabwe (GMAZ) has bought 174 854 mt of maize which represents 60 percent of the total sales worth $41 900 160 which was meant to pay grain delivered by local farmers augmenting what treasury was giving us,” he added.

So far maize seeds amounting to 15 700mt under Presidential inputs scheme have been delivered to farmers. Other inputs which were delivered include, 9 574mt soya beans, 979mt small grain, 69 200mt compound D fertiliser and 22,239mt top dressing fertiliser.

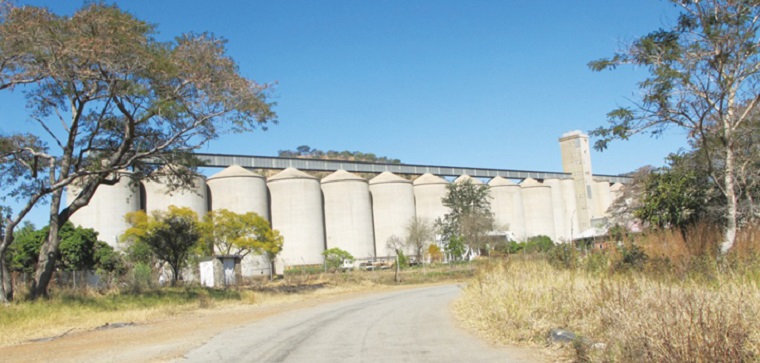

Mutanhu also said that GMB secured $6.3 million from treasury to construct hardstands at its 12 depots to ensure safety from rain damage.

GMB targets to rehabilitate electrical and mechanical works at its silos in the first quarter of this year at an estimated cost of $22.3 million and installation of grain dryers at a cost of $15 million upon availability of foreign currency.

GMB has outstanding fees of $68 million and short term debts amounting to $36 million.- The Source

(61 VIEWS)