The Zimbabwe dollar today firmed to its highest level on the Optional Market Implied Rate since the foreign currency auction started on 23 June last year indicating investor confidence in the local currency.

The Zimbabwe dollar today firmed to its highest level on the Optional Market Implied Rate since the foreign currency auction started on 23 June last year indicating investor confidence in the local currency.

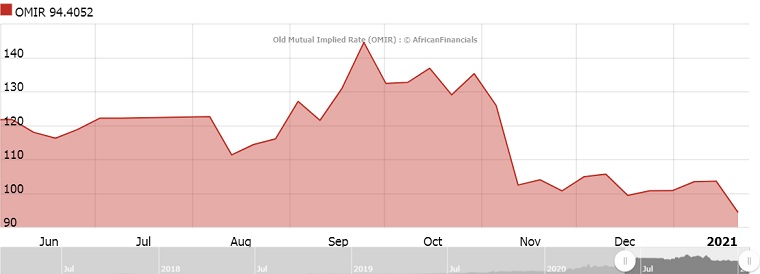

The OMIR used to be called the Old Mutual Implied Rate and was used by investors as the real exchange rate for the local currency. It was the difference between the price of Old Mutual shares in Harare and London.

It was reportedly playing so much havoc in the market that the government suspended trading in Old Mutual shares in June last year.

African Financials which maintains the OMIR says the Optional Market Implied Rate is a service for investors looking to arbitrage share price and exchange rate mismatch opportunities in African Stock Markets.

The OMIR rate was $128.37 when Zimbabwe held its first foreign currency auction at which the Zimbabwe dollar averaged $57.36.

The Zimbabwe dollar continued to fall against the United States reaching a peak of $83.40 on 25 August but it continued to plunge on the OMIR peaking at $144.57 on 21 September.

The local currency began to firm against the greenback on the foreign currency auction settling at $81.35 for the whole of October before easing gradually to $82.08 this week.

It started appreciating on the OMIR but continued to fluctuate reaching a high of $94.41 today. It was at $107.71 last week and $101.42 yesterday.

(191 VIEWS)