Zimbabwe has allowed banks to set their own rates for exchanging US dollars in transactions of up to US$1 000, as it seeks to ease pressure on weekly currency auctions and to tame a runaway parallel market.

Zimbabwe has allowed banks to set their own rates for exchanging US dollars in transactions of up to US$1 000, as it seeks to ease pressure on weekly currency auctions and to tame a runaway parallel market.

Lenders can now use “a willing-buyer, willing-seller basis” rather than being restricted to the official exchange rate for the local dollar, central-bank Governor John Mangudya said in an interview in Harare, the capital.

“It’s a second window outside of the auction market,” he said. “We hope it will give confidence in the market and people will go to banks to exchange their dollars instead of going to the streets.”

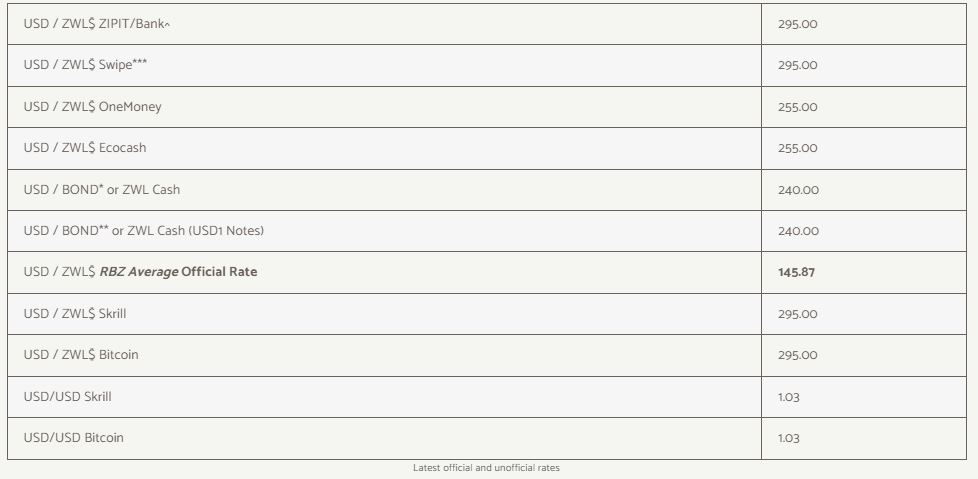

The Zimbabwean unit is priced officially at Z$145.87 per US dollar, but trades at Z$260 in the parallel market, according to ZimPriceCheck.com, a website that tracks both official and unofficial rates.

The move is an acknowledgement of pressure on the currency. Mangudya has previously rejected calls from industry to devalue the local unit and close the gap to the black-market price. He had described that as “chasing one’s tail.” The dysfunction had also helped spur inflation, which reached 73% in March.

Mangudya plans to meet with bankers to find out how the plan, first announced in a monetary policy committee statement on Monday, is being implemented. Banks should clearly display their exchange rates, much like retailers openly offer discounts for payments made in US dollars, he said.

Chains such as OK Zimbabwe Ltd., the largest retailer, and South Africa’s Pick n Pay Stores Ltd. offer 50% off for payments made in foreign currency.

The Reserve Bank’s weekly foreign-exchange auction, which began in June 2020, caters for currency requests from small businesses and large corporates. A payments backlog of US$200 million — that’s now been cleared — built up after the central bank fell behind in disbursing foreign currency, pushing companies to turn to the parallel market to get US dollars.- Bloomberg

Official and unofficial rates 7 April 2022

(215 VIEWS)