Turnall: Falling demand

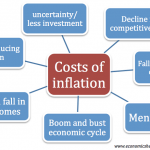

The building materials company saw third-quarter volumes down 34%, “mainly due to a change in the sales mix which was skewed towards the high value and low tonnage building products; coupled with a decline in the aggregate demand due to liquidity challenges in the market.”

TM Pick n Pay: Quiet tills

Between April and June, sales volumes in the supermarket grew by 38.53%. But, in the three months to September, units sold fell by 4.40%. The company says: “The measures introduced by the authorities to curb rising inflation, starved the economy of ZWL liquidity leading to reduced customer spending.”

OK Zimbabwe: Excessive costs

According to OK Zimbabwe: “Interest rates were increased to 200% with effect from 1 July 2022, including on debt arrangements entered into before that date. This has made borrowing costs excessive resulting in liquidity pressures across the entire supply chain.”

Simbisa: Clipped wings

Says Simbisa: “The Group commends efforts by the Reserve Bank to stabilise the country’s local currency in the period after the Group’s reporting date. However, the Group urges the Reserve Bank of Zimbabwe to review minimum productive sector lending rates which are currently set at 200% as this may stifle growth in the medium term.”- NewZWire

(104 VIEWS)

Pingback: Zimbabwe dollar down to $654.87 to the US dollar | The Insider