For months, the US has thundered toward a debt limit crisis. Democrats refused to negotiate, and Republicans insisted on a deal stocked with right-wing policy priorities. More recently, President Biden has agreed to have his staff meet directly with Speaker Kevin McCarthy’s aides, and the chances of getting a deal to increase the borrowing limit now seem higher.

For months, the US has thundered toward a debt limit crisis. Democrats refused to negotiate, and Republicans insisted on a deal stocked with right-wing policy priorities. More recently, President Biden has agreed to have his staff meet directly with Speaker Kevin McCarthy’s aides, and the chances of getting a deal to increase the borrowing limit now seem higher.

Republicans have now demanded that any deal must include stricter work requirements for social safety net programs. Biden has hinted that he might be willing to accept such a bargain, drawing a backlash from liberal congressional Democrats, who have begun openly fretting that the president might agree to a deal they cannot accept.

The pushback reflects the political crosscurrents at play in the talks between Biden and McCarthy, both of whom have to contend with slim majorities in Congress and uncompromising political bases that will find any agreement hard to swallow. But the U.S. is essentially living paycheck to paycheck, and the unknown date on which the cash runs out is looming.

Consequences: If Congress does not increase the debt ceiling — the limit on money that the US can borrow — the government may run out of money as early as 1 June. The government would no longer be able to pay its bills, potentially defaulting on its debts. That situation could send the financial markets, and the economy, into chaos.

“We are sailing into uncharted waters,” one expert said.

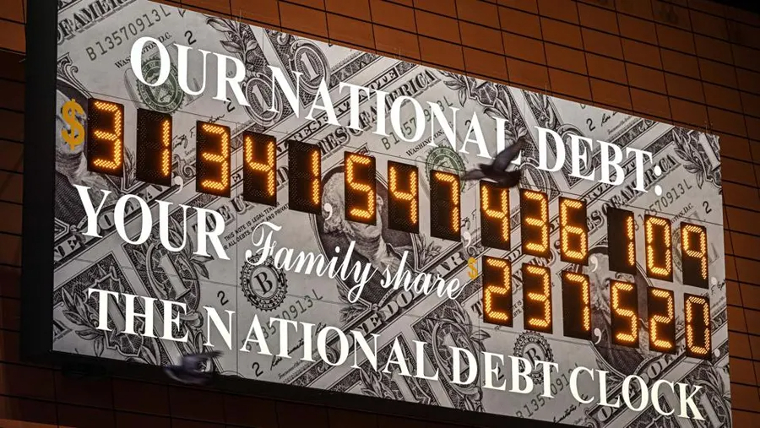

Debt: The US reached its statutory debt limit of US$31.4 trillion on 19 January.-NYTimes

(125 VIEWS)

Pingback: Ziyambi says Mliswa and Biti should suggest ways of strengthening Zimbabwe dollar not to just say they prefer the US dollar | The Insider