A United States economist says the International Monetary Fund and the British magazine, The Economist, are lying about Zimbabwe’s hyperinflation figure.

Steve Hanke of the libertarian Cato Institute, a United States think tank, says the IMF has been providing faulty data about Zimbabwe which The Economist went on to use.

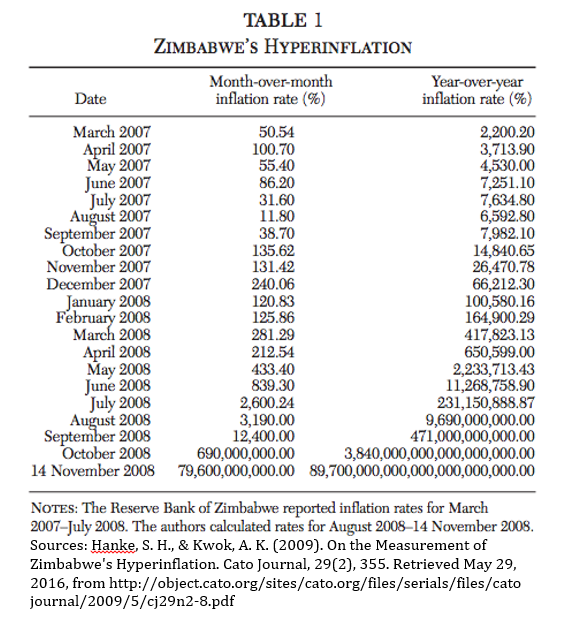

He says the IMF puts Zimbabwe’s record inflation at 500 billion percent, the same figure cited by The Economist, but the real figure was 89 sextillion percent.

“Most press reports about Zimbabwe’s fantastic hyperinflation are off the mark – way off the mark,” Hanke wrote for the Cato Institute. “Even our most trusted news sources fail to get the facts right. This confirms the ‘95 Percent Rule’: 95 percent of what you read in the financial press is either wrong or irrelevant.

“When it comes to the reportage about hyperinflation, there are no excuses. All 56 of the world’s hyperinflations have been carefully documented in ‘World Hyperinflations’. This record is available in the Routledge Handbook of Major Economic Events in Economic History (2013) and has been available online since 2012 at the Cato Institute.

“The International Monetary Fund (IMF) is the main culprit, a prominent source of the faulty data. Even The Economist magazine has fallen into the trap of uncritically accepting figures pumped out by the IMF and further propagating them. It’s no wonder that there is a massive gap between the public’s perception and economic reality. A gap that, ironically, The Economist reports on this week.”

There has been a surge in interest about Zimbabwe’s hyperinflation which occurred eight years ago following the announcement by Central Bank governor John Mangudya that the country intends to introduce bond notes to ease the cash crisis that has gripped the country.

Zimbabweans have flatly rejected the proposed notes, which will be introduced in October, because they fear it will bring back the hyperinflation that bedeviled the country in 2007-2008 when then Central Bank governor Gideon Gono went on a money printing spree which saw the country producing a $100 trillion note which could hardly buy a loaf of bread.

Zimbabwe is negotiating new loans with the IMF and was asked to pay its arrears of nearly $1.8 billion first. The arrears are with the IMF, the World Bank and the African Development Bank.

In his article on Friday, Hanke wrote: “The Economist’s most recent infraction on Zimbabwe’s hyperinflation appeared in the May 2016 issue. The magazine claimed that the hyperinflation peaked at an annual rate of 500 billion percent. Where did this figure originate? You guessed it. That figure is buried in the IMF’s 2009 Article IV Consultation Staff Report on Zimbabwe.

“In reality, Zimbabwe’s annual inflation rate in September 2008 was 471 billion percent, not 500 billion percent. More importantly, Zimbabwe’s hyperinflation peaked in November, not September. It was then that Zimbabwe recorded the second-highest hyperinflation in history: a whopping 89.7 sextillion percent. This is 179 billion times greater than the IMF’s figure.”

(400 VIEWS)