I was shocked when I read a story the other day that more than 2 000 Zimbabweans had just lost their houses after they were auctioned because banks wanted to recover $700 million that they owed.

It pained me because I know that there is a simple formula that most people can use to save their houses and at very little extra cost.

I discovered this formula way back in 1984 when a friend of mine bought a brand new Renault 18.

I had bought a house a year earlier, but started wondering why my friend was given three years to pay off the car, which was more expensive than my house, when I was given 25 years to settle my mortgage.

Of course one of the reasons that made me rethink was that when you are in town, one with a car is more visible than one with a house even if the house is more expensive than a car because you do not move around with your house.

I discovered then that with the repayments I was making I would have paid more than three and a half times the loan I had borrowed from the bank.

I also discovered that it was quite simple to pay much less than that and at the same time save my property from repossession in case I defaulted on my repayments say because of loss of employment or falling ill.

In fact, I discovered that it so easy to pay half the amount I was expected to pay after 25 years.

I applied this simple formula and paid off my house in 7 years. In the meantime I had moved cities and bought a flat. I paid it off in two years. In fact I paid off the flat before my first house.

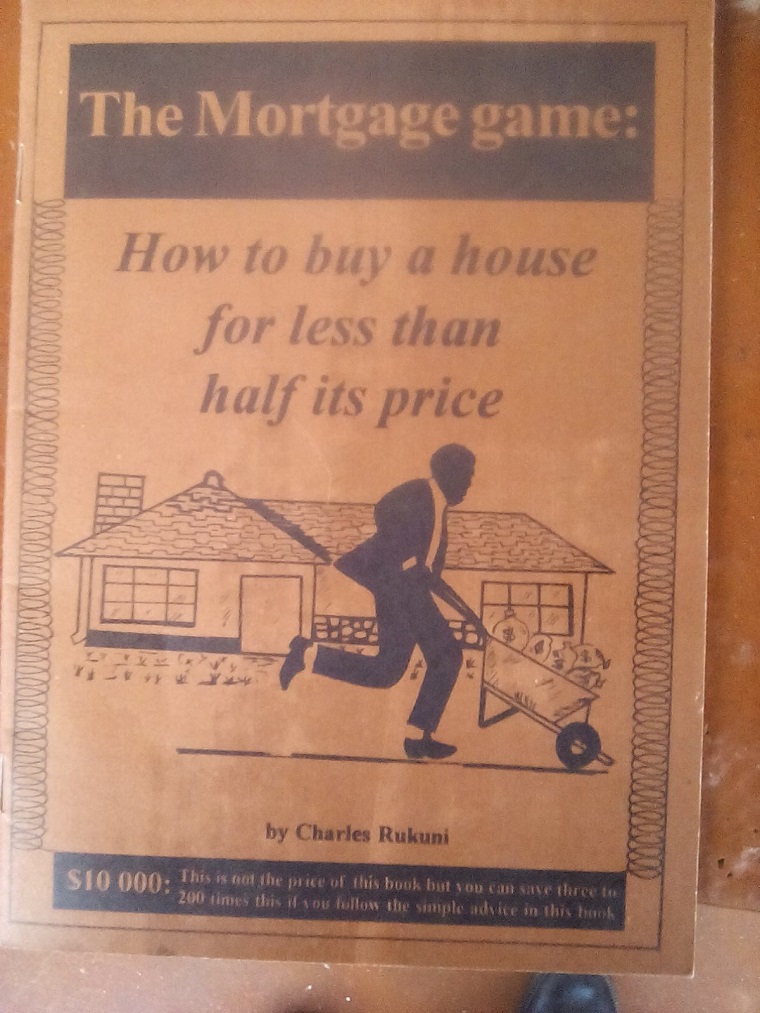

I therefore decided to write a small guide on how to do this in 1994.

The booklet was entitled: How to buy a house for less than half its price.

Continued next page

(304 VIEWS)