The Reserve Bank of Zimbabwe yesterday said it will be publishing every week a list of fuel suppliers allocated foreign currency to procure fuel that will be sold in the local currency.

The Reserve Bank of Zimbabwe yesterday said it will be publishing every week a list of fuel suppliers allocated foreign currency to procure fuel that will be sold in the local currency.

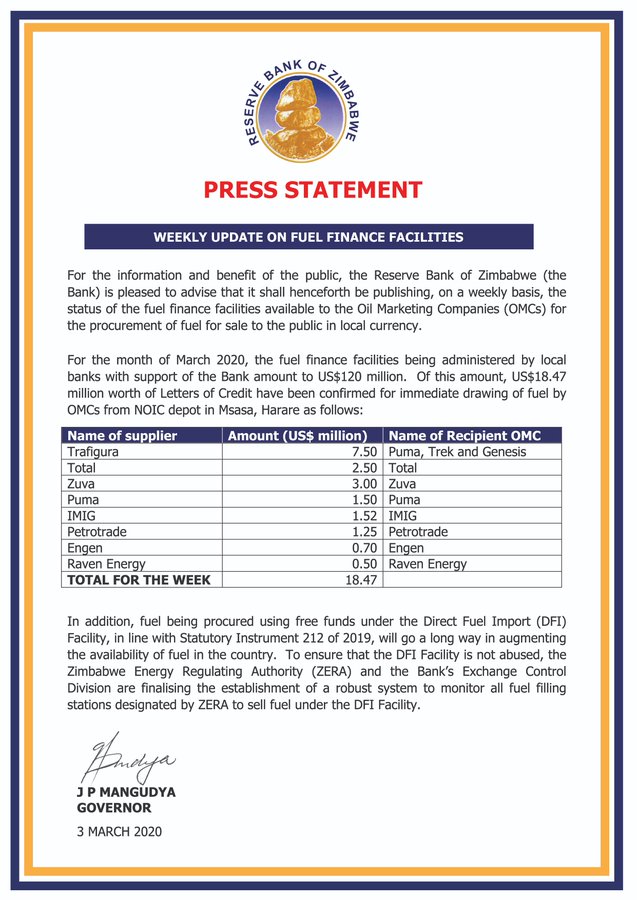

It said it will be disbursing US$120 million this month and has allocated the first US$18.47 to Trafigura, Puma, Total, Zuva, IMIG, Raven, Petrotrade and Engen.

Trafigura got the bulk of the amount.

It said the fuel supplies with be augmented by supplies now being sold in foreign currency.

Zimbabwe now allows suppliers with free funds to import fuel which they can sell in foreign currency.

Those willing to do so were given until yesterday to register.

The move has been seen by some as capitulation by the government and an admission that de-dollarisation has failed.

The Reserve Bank maintains that it is on track and will take about five years.

Economist, Eddie Cross, a member of the Monetary Policy Committee, said the authorities had decided to slow down the process of de-dollarisation to allow people with foreign currency to use it and thus bring hard currency into the formal sector.

“We have formalised the use of the RTGS dollar and our paper currency and today over 90 per cent of all transactions are made in these currencies in domestic markets,” he said.

“The talk of re-dollarisation is simply a lack of understanding, we are de-dollarising our economy but recognising this will take years, not months.

“We have to re-establish confidence in our own currency and our ability to protect and maintain its real value. So long as people think it is not a safe vehicle for savings, people will retreat to the US dollar as a store of value – just like gold in previous centuries.

“The reality is that there is much more US dollar cash in our economy than our own currency. We are trying to remedy that but it takes nearly a year to get a new currency designed and printed and put into circulation.

“In the meantime, the existing currency actually trades at a 30 per cent premium in local markets over the RTGS dollar.

“It is even widely traded in neighbouring States. So the State has decided to slow down the process of de-dollarisation and to allow people to use their own foreign funds on the domestic market. This will tap into the very considerable volume of hard currency that is being traded in the informal economy and assist us in meeting demand for essential imports.”

Click link below to receive updates by whatsapp

https://chat.whatsapp.com/IjKB2tQriIv3s0CUZMVUPS

(82 VIEWS)