Zimbabwe’s national debt now stands at $18.4 billion, according to Zimbabwe’s fact checking organisation, Zimfact.

It says as of last December, foreign debt stood at $7.5 billion and was expected to increase to $7.8 billion due to interest and penalties, according to Finance Minister Patrick Chinamasa’s 2018 budget.

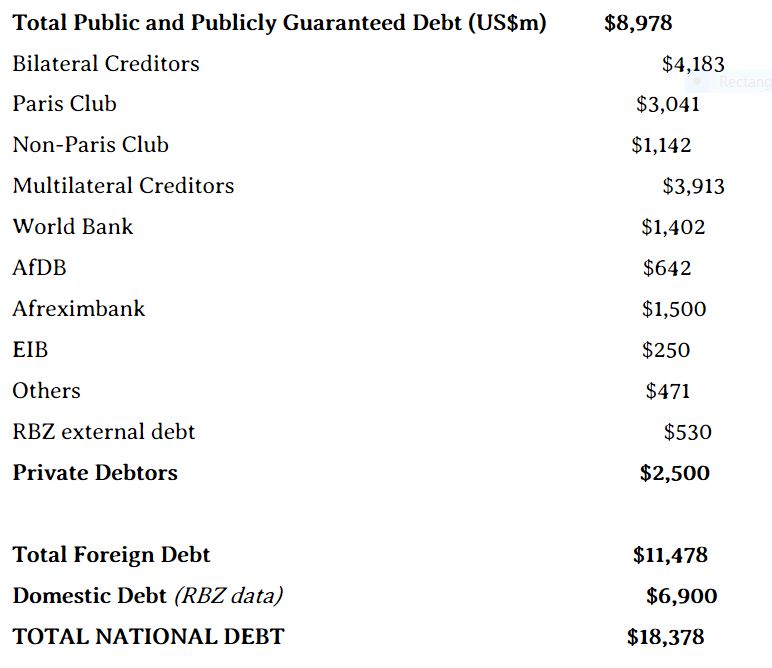

However, the foreign debt stock only refers to the government and parastatals. It excludes private sector foreign debt, which is estimated at $2.5 billion. That puts the country’s foreign debt at a minimum $10 billion.

Still, the figure does not include the $1.5 billion borrowing from the Africa Import and Export Bank (Afreximbank) that was announced by the RBZ Governor John Mangudya in the January monetary policy statement. This increases the country’s foreign debt stock to at least $11.5 billion.

Domestic debt increased from $4 billion at end of $2016 to $6 billion at the end of $2017 and is seen rising further to $6.7 billion this year, according to national budget figures. This is on the back of increased deficit financing through issuance of Treasury Bills and a growing government overdraft at the RBZ that reached $1 billion.

The RBZ figures on the other hand put domestic borrowing by the government and parastatals higher, at $6.9 billion.

Using the RBZ and budget figures, public and private, foreign and domestic debt at the end of 2017 is therefore $18.4 billion, which is 95 percent of the estimated GDP for 2018.

Below is a breakdown of Zimbabwe’s foreign and domestic Debt end 2017:

(2120 VIEWS)