Zimbabwe has to date issued Treasury Bills totalling $4.417 billion since 2014 with $3.315 billion of those being current, Finance Minister Patrick Chinamasa has said, admitting increased reliance on the paper to bridge the state’s funding gap and to clear legacy debts.

The government resuscitated the Treasury Bill (TB) market in October 2012 and with no access to foreign money, Zimbabwe has turned to the local market, with TBs the primary instrument for raising the cash.

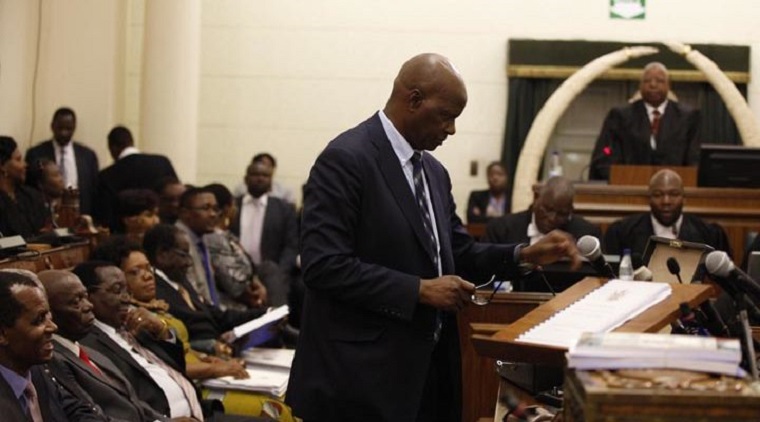

“Government issued TBs to raise money to fund its programmes, service government debts, the Reserve Bank of Zimbabwe debt and recapitalisation of public institutions, and we also took over collateralized non performing loans by the Zimbabwe Asset Management Corporation,” Chinamasa told Parliament yesterday.

Most of the TBs are held by banks, who prefer the risk free nature of the promissory notes to private lending in a non-performing economy with high levels of bad debts.

Some analysts contend that the purchase of TBs by banks has crowded out lending to the productive sectors, while compounding liquidity shortages in the economy.

Chinamasa said $1.102 billion TBs have matured and have been liquidated, leaving $3.315 billion outstanding by March 3 this year.

“25 percent of the amount raised went towards financing of government programmes while 75 percent went towards dispersing legacy debts, and government has been honouring its obligations on maturing TBs as demonstrated by a total $1.102 billion so far repaid timeously,” he said.

Government had funded projects such as Tokwe-Mukosi using TBs, he said, adding in the past infrastructural development was funded by the World Bank, African Development Bank and other institutional investors.

“On financing of legacy debts, government draws services from private and public institutions which should be paid for. Unfortunately, government has been consuming services without paying, resulting in the accumulation of domestic arrears which negatively impacted operations of industry,” said Chinamasa.

TBs worth $925.5 million were issued to settle central bank debts and, of this $59.2 million has since been repaid while $866.3 million is outstanding.

Government had also extended $196.87 million towards the recapitalisation of public institutions.

“With respect to issuance of TBs for the financial services sector, we noted that non-performing loans threatened to cripple them and, as at March 3 2017, the total non-performing loans amounted to $503 947 700, and banks ended up imposing stringent conditions to customers,” said Chinamasa.

Government plans to resuscitate CAPS Holdings and Cottco Holdings by warehousing the companies’s debts, he added.-The Source

(322 VIEWS)