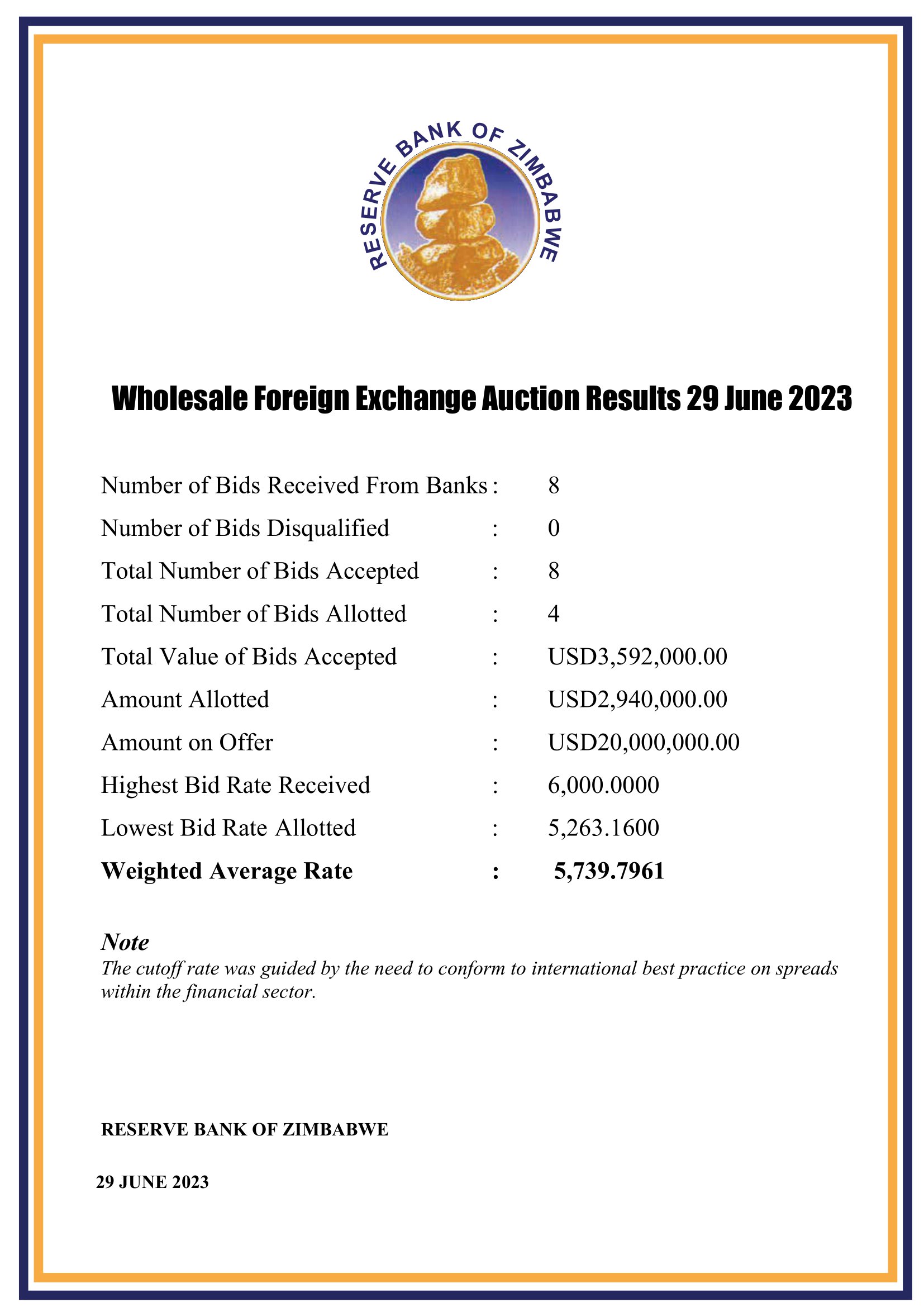

The Zimbabwe dollar continues to appreciate against the United States dollar and yesterday averaged $5 739.7961 at the wholesale auction up from $6 326.5877 on Tuesday and $6 926.5764 on 20 June, the lowest the local currency has fallen to since the reintroduction of the local currency.

The Zimbabwe dollar continues to appreciate against the United States dollar and yesterday averaged $5 739.7961 at the wholesale auction up from $6 326.5877 on Tuesday and $6 926.5764 on 20 June, the lowest the local currency has fallen to since the reintroduction of the local currency.

The country’s reserve bank now has two auctions, one for small businesses and the other for commercial banks to procure foreign currency for their clients.

What was interesting at yesterday’s wholesale auction was that only US$2.9 million was taken up when US$20 million was on offer.

On Tuesday US$10 million was taken up when US$30 was available.

Offers by the banks ranged from $5 263.16 to $6 000 which is an indication that the local currency will firm even further.

There had been fears that the local currency will continue to tumble until after the elections.

Those who argue for dollarisation say the firming of the local currency is temporary and largely attribute it to the scarcity of the local currency as companies seek it to settle their quarterly taxes.

They say it will tumble once companies have paid their taxes, but it appears business is increasingly realising that its survival is anchored on the local currency. Dollarisation will adversely impact the productive sector.

The government has ordered companies to pay half of their taxes, normally paid in foreign currency, in the local currency. It will also not accept payments in any foreign currency for taxes normally paid in Zimbabwe dollars.

(103 VIEWS)