Innscor is one of Zimbabwe’s most dominant companies, running thriving businesses from stockfeed to groceries. But the country’s competition commission is keen on chipping away at part of what it sees as too much “market power”.

Innscor is one of Zimbabwe’s most dominant companies, running thriving businesses from stockfeed to groceries. But the country’s competition commission is keen on chipping away at part of what it sees as too much “market power”.

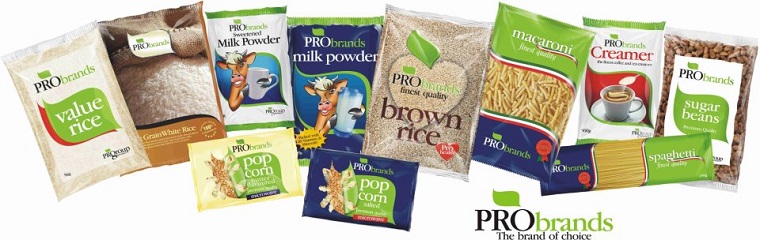

In a new ruling, the Competition and Tariff Commission (CTC) says Innscor should sell its shares in Probrands, one of the country’s biggest producers of groceries, and pay a fine of the equivalent of US$9 million for not notifying it of that acquisition.

In 2016, Innscor’s investment vehicle Ashram bought 39.2% stake in Probrands, controlled by Amiata Investments. In 2018, Probrands sold its dairy assets to a new unit, Prodairy, in which Innscor then held 50.1%. The Probrands deal was put to CTC for approval in 2019. The commission says that should have been done before the transaction.

According to CTC, the merger creates unfair competition, seeing as Innscor already controls National Foods, the biggest manufacturer of basic goods in the country.

CTC said that deal “substantially lessened competition by according Probrands/National Foods the ability to exercise market power as a result of the lower competitive constraints between the merging parties. This merger created a single firm with anticompetitive effects as well as substantial market power with long lasting consequences on consumers.”

The transaction must be reversed and Innscor must pay a fine, CTC says.

“In light of the foregoing, it is recommended that the Commission: i) Prohibits the Ashram/Amiata merger and orders Ashram to divest from Amiata forthwith; and ii) imposes a penalty of US$9 143 597.86 or its equivalence in ZWD at the time of settlement on IAL for consummating the merger without the Commission’s approval.”

Innscor’s innovative investments in the dairy sector are also under scrutiny. Innscor’s Prodairy is one of the big-three dairy companies, accounting for 20% of the country’s raw milk intake.

Innscor has invested heavily to take the competition to rivals Dendairy and Dairibord, the largest player. To do this, Prodairy has merged with another processor, Kershelmar, to increase processing. On the raw milk supply side, Innscor has formed a joint venture with dairy producer Mafuro Farming.

This is good competition for Dairibord, CTC concedes.

“Notwithstanding that the transaction strengthens the oligopolistic nature of the dairy processing market, the merger reduced the wider market share gap that existed between DZL and its rivals ushering (in) effective competition to DZL, once a dominant player.”

Continued next page

(117 VIEWS)