The Zimbabwe dollar today shed nearly $50 to average $1 070.4171 to the United States dollar but the black market has gone haywire with the swipe rate at $2 300, more than twice the official rate.

The Zimbabwe dollar today shed nearly $50 to average $1 070.4171 to the United States dollar but the black market has gone haywire with the swipe rate at $2 300, more than twice the official rate.

It is not clear what is driving the black market but the central bank at one time said it knew the reason and was addressing it but did not state the reason.

The central bank is introducing gold-backed digital tokens on Monday, 8 May, to try to shore up the local currency.

The digital tokens will serve both as a store of value with a vesting period of 180 days as well as for transactions.

More than 70% of the transactions in the country are now in US dollars but Finance Minister Mthuli Ncube has ruled out scrapping the local currency saying it is playing a critical role in resuscitating local industry.

Industry and Commerce Minister Sekai Nzenza says capacity utilisation in industry rose from 56% in 2021 to 63% last year and 80% of goods on supermarket shelves are locally manufactured.

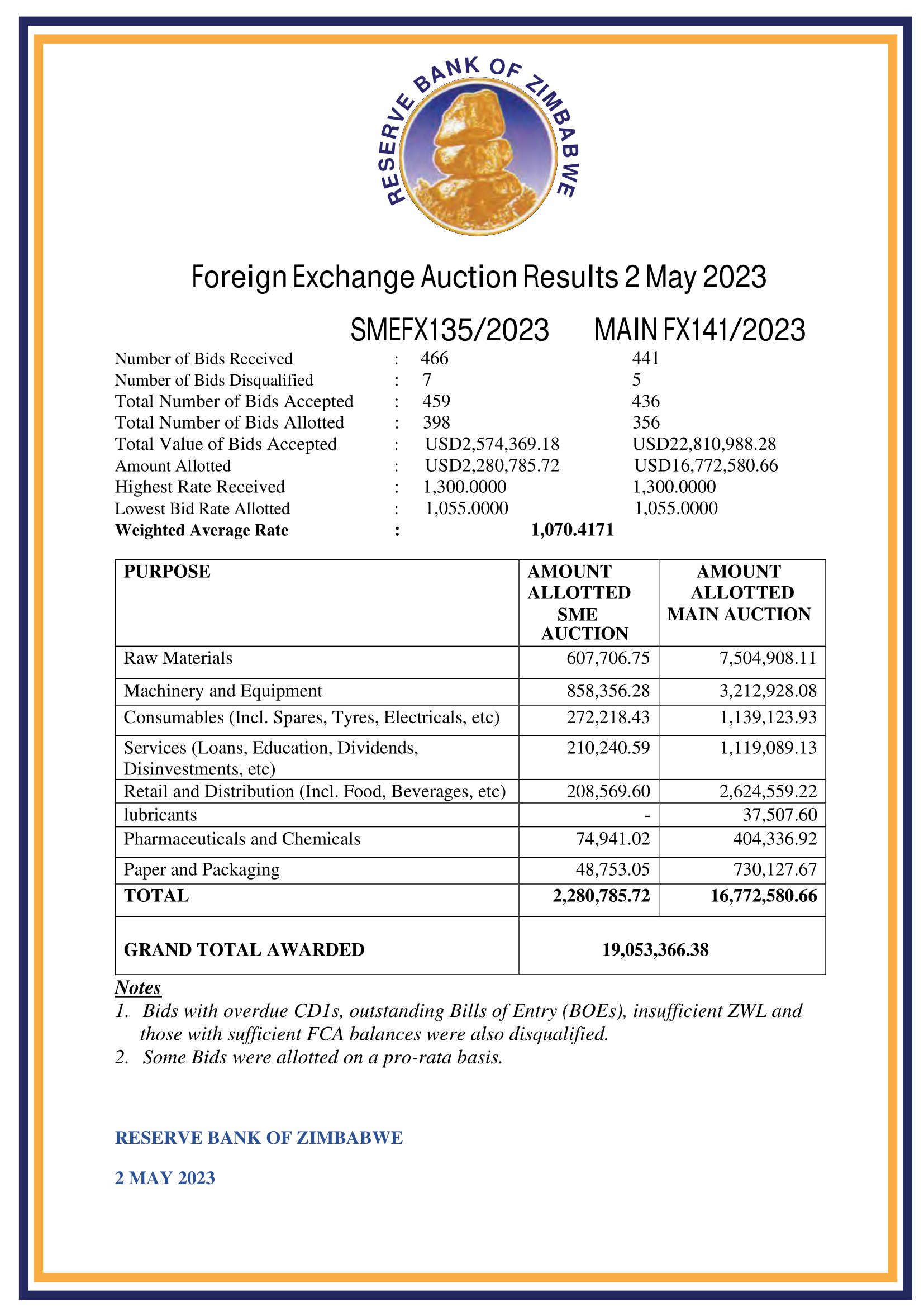

A total of US$19.1 million was allotted to 398 small companies and 356 large companies today with offers ranging from $1 055 to $1 300.

The black market cash rate is put at $1 500 while the mobile money rate has shot up to $1 950.

(263 VIEWS)

Pingback: Zimbabwe black market goes haywire – Paktweet