WestProp Holdings failed to sell a single share on its first day of trading at the Victoria Falls exchange today.

WestProp Holdings failed to sell a single share on its first day of trading at the Victoria Falls exchange today.

It was, however, not the only company on the 11-member exchange that did not sell any shares today as five others did not and another five did.

The opening price for its shares was US$10. It closed at the same price.

WestProp failed dismally to raise money through its initial public offer, selling only 1 405 ordinary shares at US$10, each, out of one million. It therefore raised a mere US$14 050 instead of US$10 million, a subscription level of a paltry 0.14%.

Preference shares offered to the public did not fare well either with the company selling 55 318 shares out of 5.4 million at US$5 each, raising only US$276 590 instead of US$2 million.

The bulk of the preference shares, 600 000, were bought by the underwriter raising US$3 million.

All in all the company raised US$3 290 640 instead of US$40 million, a subscription level of only 8.23%

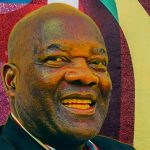

WestProp chief executive Ken Sharpe said investors should not despise this humble beginning “because we will be coming back to the market with a fresh round of preference shares”.

WestProp was supposed to be listed on the Vfex on 28 April but this was delayed following a legal challenge that it had not disclosed all the litigation cases against the company.

This has since been rectified, but the battle for some of its key assets is not yet over.

(123 VIEWS)