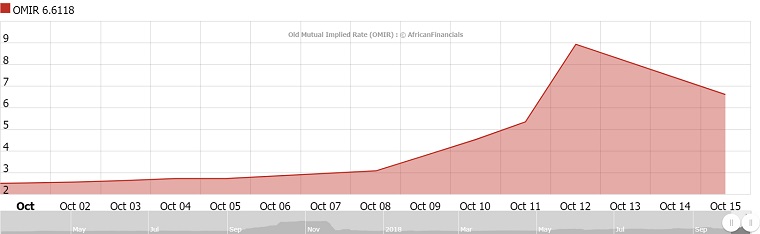

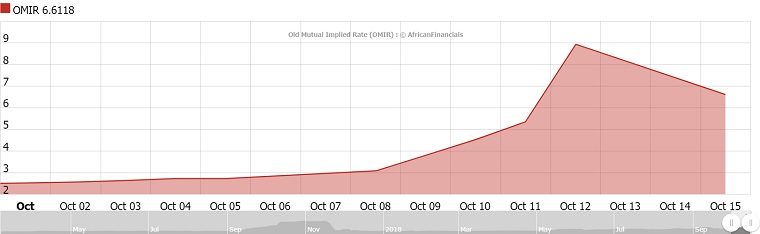

The Old Mutual Implied Rate which is used mainly by business to gauge the market value of the bond note and electronic money against the United States dollar today dropped from an all-time high of 8.9338 on Friday to 6.6188.

The Old Mutual Implied Rate which is used mainly by business to gauge the market value of the bond note and electronic money against the United States dollar today dropped from an all-time high of 8.9338 on Friday to 6.6188.

This is still quite high as the previous peak was 5.7905 reached on 23 October last year.

The OMIR is based on the difference between the share price of Old Mutual on the London and Harare stock exchanges.

The OMIR stood at 2.446 at the end of September but started rising after the 1 October monetary policy statement by Reserve Bank of Zimbabwe governor John Mangudya and the announcement of a 2 percent tax on transactions by Finance Minister Mthuli Ncube.

Although the street black market rate plunged on Thursday and Friday, the OMIR continued to rise peaking at 8.9338 on Friday.

President Emmerson Mnangagwa yesterday said illegal foreign currency trading is now being treated as a serious national security threat.

He said shadowy figures were trashing the local currency through electronic platforms.

Central bank governor John Mangudya said influential people were behind the illegal foreign currency trading with one pushing $48 million onto the market.

(1263 VIEWS)