Today is the third quarterly payment date (QPD) for the year, the second after the introduction of Zimbabwe’s new currency, the Zimbabwe Gold (ZiG).

Today is the third quarterly payment date (QPD) for the year, the second after the introduction of Zimbabwe’s new currency, the Zimbabwe Gold (ZiG).

Central Bank governor John Mushayavanhu promised that QPDs would be used to strengthen the local currency as businesses are now required to pay half their taxes in local currency, thus pushing demand for the ZiG.

He had promised that the ZiG would firm significantly in June, the second QPD, but it turned out that the government had failed to turn the compulsory payment of half the taxes in ZiG into law.

The ZiG, which was introduced in April, had stood its ground in the first 5 months of its introduction but it has been on the decline since 28 August.

It has dropped from 13.8156 to 13.9912 today but the drop on the black market has been significant.

Zimprciecheck.com, which monitors the exchange rates on both the official and black markets, puts the black market rate at 28:1. Local newspaper, Newsday, however said it was as low as 40:1.

Now major retailers are calling for a market-determined exchange rate or they will face collapse.

The central bank has injected more than US$100 million to shore up the local currency and ease the foreign currency shortage in the country.

Ironically the country’s banks are holding about US$2.7 billion in deposits but according to Sekai Kuvarika of the Confederation of Zimbabwe Industries, no one apart from the government is willing to sell their foreign currency.

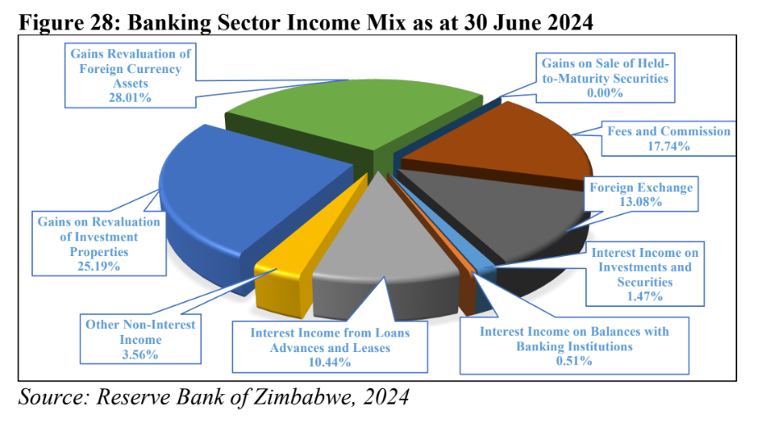

While banks in most countries make most of their money from interest charges, in Zimbabwe they are making their money from fees and commissions.

According to the central bank, the country’s commercial banks earned 17.74% of their income from fees and commissions as at 30 June.

Interest income from loans and leases accounted for 10.44% while they earned only 1.47% from investments and securities.

Investopedia says the ideal loan-to-deposit ratio for most banks in the world is 80 to 90%. Banks in Zimbabwe are only lending half the deposits.

(5554 VIEWS)