Zimbabwe’s Monetary Policy Committee has resolved that the country should put in place a formal market-based system of foreign exchange.

Zimbabwe’s Monetary Policy Committee has resolved that the country should put in place a formal market-based system of foreign exchange.

It also reinstated the 30-day limit of liquidating surplus foreign exchange receipts from exports from 1 July.

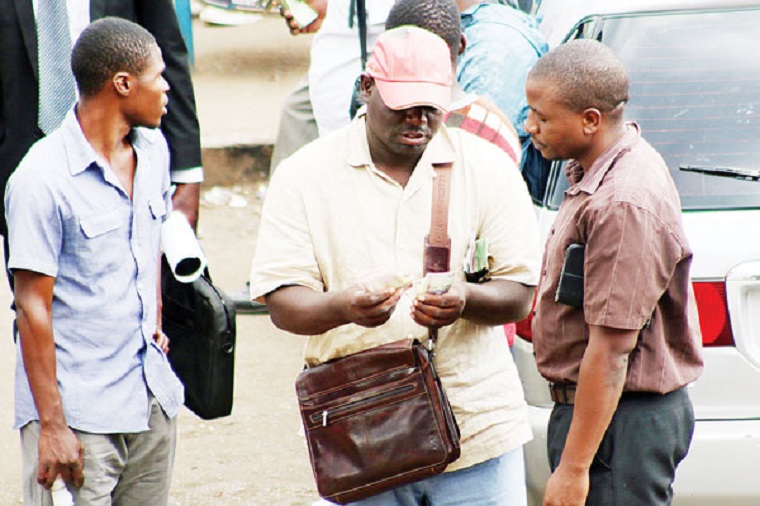

According to a statement released by the Reserve Bank of Zimbabwe today, the committee, which met on 22 May, expressed serious concern over the continued deterioration in the exchange rates hat were being used by the private sector.

The central bank pegged the local currency at 25:1 against the United States dollar in March as part of the response to the outbreak of the coronavirus in the country.

The market, however, ignored that exchange rate and used its own to mark-up prices.

An agreement with the private sector to revert to prices that prevailed in March was never implemented.

Today, the local currency was trading at between $72 and $79 to the greenback, according to Marketwatch.

The Old Mutual Implied Rate was at $117.49.

According to the statement by the RBZ, the committee welcomed action taken by the Bank to curb speculative trading in foreign exchange using electronic banking platforms.

“It was resolved that a formal market-based system of foreign exchange trading will be put in place. To ensure that foreign currency trades were monitored in real time, the committee urged the Bank to expedite the implementation of the electronic foreign exchange trading system for compulsory use by bureaux de change,” the statement said.

“The committee also urged more active application of the Open Market Operations (OMO) Bills to deal with any identified excess liquidity balances in the market.

“As part of efforts to assist in the recovery and growth of the productive sectors of the economy and to help with post Covid-19 recovery, it was resolved that there was need to release more financial resources for the productive sectors of the economy by banks. To assist that process, the committee resolved to reduce the statutory reserve ratio from the current 4.5% to 2.5% with effect from 8 June 2020.

“The committee also resolved to reinstate, with effect from 1 July 2020, the 30-day limit of liquidating surplus foreign exchange receipts from exports in order to ensure that more foreign exchange was released onto the market.”

(163 VIEWS)