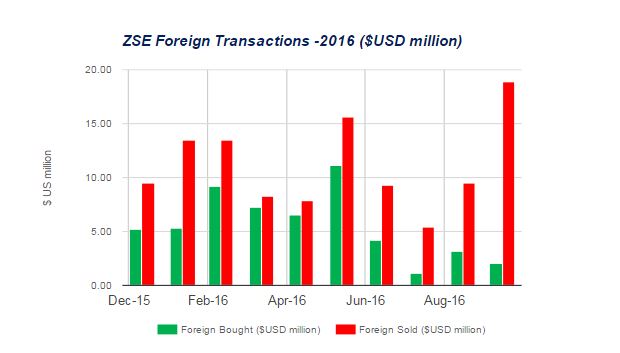

Foreign buyers are deserting the Zimbabwe Stock Exchange in record numbers, with net outflows of $56.28 million in the 10 months to October, the biggest sell-off in five years over government plans to introduce a token currency in the financial system.

Zimbabwe has sort to contain a dollar shortage by introducing local ‘bond notes,’ which it said will trade at par with the US dollar.

President Robert Mugabe on Monday used the Presidential Powers (Temporary Measures) Act to amend the Reserve Bank of Zimbabwe Act to designate the bond notes as legal tender, effectively launching the new currency.

But questions remain about the legality of the instrument, which was used to bypass Parliamentary approval.

In May, the central bank announced its plans to circulate bond notes alongside the US dollar and other currencies in Zimbabwe’s multi-currency basket, which also includes South Africa’s rand, Botswana’s pula, China’s yuan, the euro, British pound and Japan’s yen.

The central bank says the surrogate currency will be backed by a $200 million facility provided by the African Export Import bank.

The bank has not said when the notes will be brought into circulation.

Zimbabwe has suffered from a crippling dollar shortage since the beginning of the year, but foreign investors appear to be unimpressed with the government move to introduce a local currency, eight years after it ditched the hyperinflation ravaged Zimdollar.

The central bank insists that the bond notes are not local currency but President Mugabe has called them a ‘surrogate currency’ while vice president Emmerson Mnangagwa on Tuesday called them ‘a mode of transaction that is domestic.’

Continued next page

(225 VIEWS)

Pingback: UK says it cannot interfere with Zimbabwe’s decision to introduce bond notes | The Insider