A compromised intelligentsia, in which those who would enrich public discourse on the economy are negligently timid, ceding ground to a hopelessly partisan commentariat, is a major part of the discourse problem too.

Many called for an end to subsidies and a shift to a market-based economy, but only few remembered to mention the consequences on consumers.

The unsustainable, artificial price stability anchored on a fictitious exchange rate came at a huge cost. This was in the form of rampant government borrowing and prejudiced exporters who were shaken down by the central bank for their forex, which it then tried to spread around in a bid to keep everyone else happy.

The fixed exchange rate had long been a contentious issue in the economy, but government kept waving away calls to float the local currency. Eventually, government freed it up on February 22. By then, the ruinous exchange rate policy had created disruptive arbitrage opportunities in the economy, as well as widespread shortages.

The 1:1 amounted to a massive subsidy on goods ranging from basic foodstuffs such as bread, maize meal, milk and sugar to fuel, flights and even beer.

Many campaigned for the removal of the 1:1 rate – essentially a devaluation – and the dropping of expensive subsidies, but few debated what it would mean for prices. The results are now being felt.

“After years of irrational subsidies that drove money supply through the roof, it’s payback time through high inflation,” says economist Brains Muchemwa.

As government threw Treasury Bills at virtually every problem – from farm input requirements to election funding – money supply surged, peaking at 47.5% in July 2018.

By December 2018, after Finance Minister Mthuli Ncube, appointed in September, stopped TB issuances and closed the tap on runaway government expenditure, money supply had slowed down to 28%.

After Mthuli and central bank governor John Mangudya telegraphed a shift to market early October, parallel market rates went crazy, straining a population that was starting to reel from radical changes in the economy.

At a January town hall in Harare, Mthuli was asked to explain why things had become worse since he came into government.

“Things feel worse, because what was happening, literally, you had a boiling pot with a lid on it and what we did was to lift the lid. That’s what really happened and, lo and behold! There it all was!”

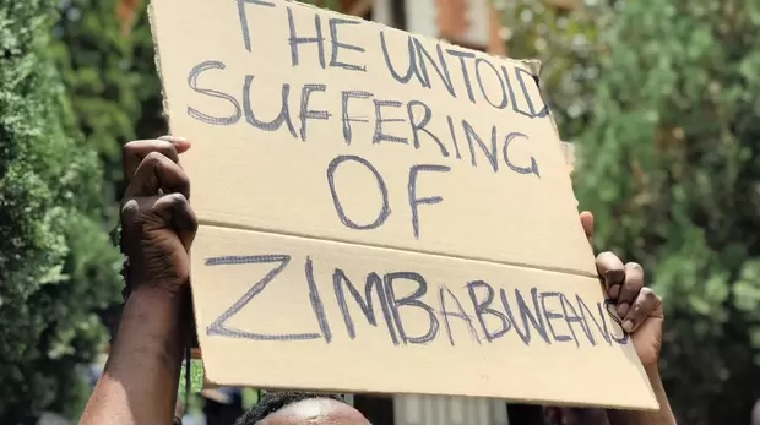

For years, prices were kept artificially stable by subsidies and the fixed exchange rate. This drove up budget deficits, as government ‘printed money’ to fill the gap. Now, the bottom line is that we are now suffering the consequences of Mthuli dismantling those subsidies, letting loose market forces on what has been a protected economy.

The problem, according to a UN panel of experts, is that there have been no ‘safety nets’.

Mnangagwa’s economic team has repeatedly made government’s market-based reform intentions clear, though the messaging was clouded by government’s inept communication problems.

Continued next page

(445 VIEWS)