Each time Tendai Biti gets up to address an MDC Alliance rally, he is greeted with ‘USA! USA!’ chants. This adulation is not for America, but its coveted currency.

Each time Tendai Biti gets up to address an MDC Alliance rally, he is greeted with ‘USA! USA!’ chants. This adulation is not for America, but its coveted currency.

Biti, Zimbabwe’s Finance Minister between February 2009 and June 2013, is associated with days when depositors had no problem accessing their dollar deposits from the banks. This is now a distant memory, as long lines at the banks re-emerged in 2016, after physical dollars predictably ran out.

An already bad currency situation took a turn for the worse last month, after an October 1 monetary policy statement by central bank governor John Mangudya seemed to herald the end of the bond note fiction.

Mangudya directed banks to separate foreign currency deposits from bond notes and electronic balances — a de facto local currency.

This precipitated the collapse of the bond note and real time gross settlement (RTGS) value on the black market, triggering price hikes and the country’s worst economic crisis in a decade.

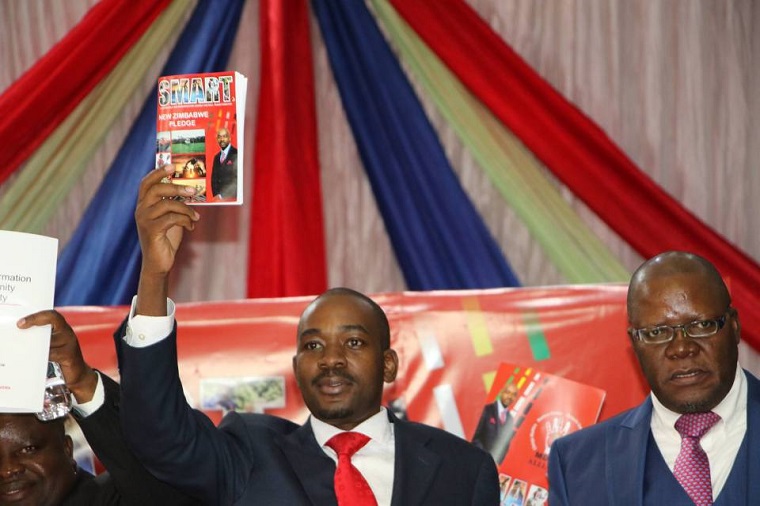

As any opposition party would, Nelson Chamisa’s MDC Alliance, still smarting from its July 30 election defeat in yet another disputed vote, has seized upon the crisis to heap coals on President Emmerson Mnangagwa and his ZANU-PF government.

But, what would the MDC Alliance do to deal with the currency crisis, had they won the vote?

In its 2018 election manifesto, the MDC Alliance identifies two sources of the currency crisis; lack of confidence in the ZANU PF government and excessive government spending.

The party proposed the following urgent interventions to address the situation, in the short-term:

- Immediate scrapping of the bond note.

- Returning to and strengthening the regime of multiple currencies

- Increasing productivity and growing GDP in order to build substantive reserves

- Ring fencing USD Dollar balances in banks at a specific date “to protect depositors against a second attack”.

If some of the MDC Alliance’s proposals sound familiar, it is because their variants appear to have been adopted by government.

There are even striking similarities in language.

Where the MDC Alliance manifesto calls for ‘returning to and strengthening the regime of multiple currencies’, the central bank’s October 1 monetary policy statement was announced under the theme ‘Strengthening the multi-currency system for value preservation and price stability.’

To be fair, this has been a running theme for the central bank since governor John Mangudya’s 4 May, 2016 policy statement on tackling the currency crisis.

Continued next page

(604 VIEWS)